How To Track Deferred Revenues With Sage 100

What is Deferred Revenue?

Deferred Revenue (or sometimes referred to as “unearned revenue”) is income for goods or services which have not yet been rendered. This revenue is recorded as a liability on the balance sheet because it represents services that are owed to the customer and as the product or service is delivered it can then be recognized as revenue on the income statement. It is similar to a customer deposit. Generally a customer deposit is when a customer pays a percentage of a purchase price up-front, whereas deferred revenue is used for service based businesses where money is collected for specific time increments.

Who uses Deferred Revenue?

One example of a business that may use deferred revenue (and probably the most common) is software companies. When software maintenance or a support contract is paid for at the beginning of a year or contract date, the revenue is recorded in the deferred revenue account and as each month of service occurs the amount is then moved from the deferred revenue account to the actual revenue account. So if a one year support contract is invoiced in December for $1200, the money is recorded in December in the deferred revenue account and each month $100 will move from the deferred revenue account to the actual revenue account. Other examples of instances where deferred revenue is used could be a publishing house that charges yearly magazine subscriptions, or even a yearly lease, where the cash is received for the entire year or a period of time up front.

Accounting for Deferred Revenue in Sage 100

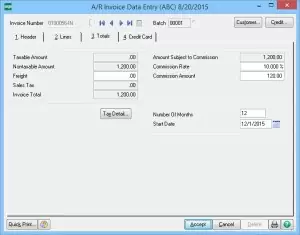

DSD offers two enhancements for Sage 100 which allow for easy accounting of deferred revenue, Accounts Receivable Deferred Revenue (ARDR) and Sales Order Deferred Revenue (SODR). These enhancements add two new fields to the Invoice Data Entry screens for ‘Number of Months’ and ‘Start Date’. When these fields are entered by the user, future postings will occur on the same day each month, automatically for the number of months specified, for each item that has a Deferred Revenue Account defined.

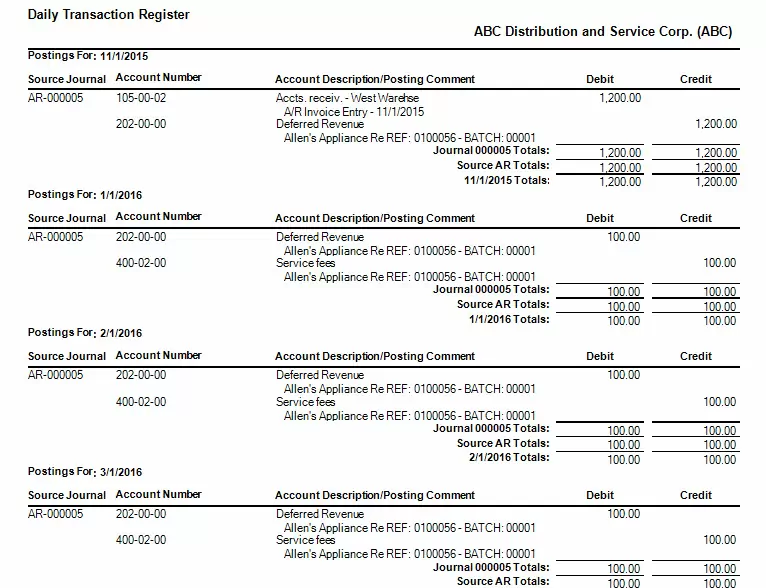

When the update of the invoice occurs, the postings are created for all months of the deferred revenue. So using our example of a $1200 support contract for twelve months, you can see the $1200 posting to the deferred revenue account and the subsequent debits of $100 each following month.

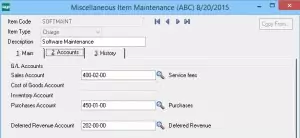

General ledger accounts for deferred revenue can be defined by miscellaneous item or by product line when using standard inventory items. Additionally the ARDR and SODR enhancements add a new history file to your Sage 100 system to keep track of “future” general ledger postings, which allows you to create a Crystal Report for deferred revenue forecasting.

General ledger accounts for deferred revenue can be defined by miscellaneous item or by product line when using standard inventory items. Additionally the ARDR and SODR enhancements add a new history file to your Sage 100 system to keep track of “future” general ledger postings, which allows you to create a Crystal Report for deferred revenue forecasting.

To view pricing or to download demos and manuals of our Deferred Revenue enhancements click the links below:

Accounts Receivable Deferred Revenue Posting (ARDR)

Sales Order Deferred Revenue Posting (SODR)

Nicole Ronchetti, Product specialist at DSD Business Systems