How to Reverse a Cash Receipt

November 3, 2015

When would a cash receipt need reversing?

Typically cash receipts are entered on a daily basis within a company. Payment is applied to open invoices and we go on with our daily duties. There are those occasional times when mistakes are made or perhaps a payment is returned for insufficient funds, in which case, a reversal of a cash receipt is necessary.

Simple steps to help reverse a cash receipt in Sage 100 that has already posted to the General Ledger:

Typically cash receipts are entered on a daily basis within a company. Payment is applied to open invoices and we go on with our daily duties. There are those occasional times when mistakes are made or perhaps a payment is returned for insufficient funds, in which case, a reversal of a cash receipt is necessary.

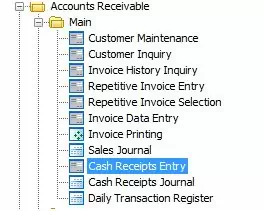

1) First you will go to the Cash Receipts Entry under the Main tab within Accounts Receivable in Sage 100.

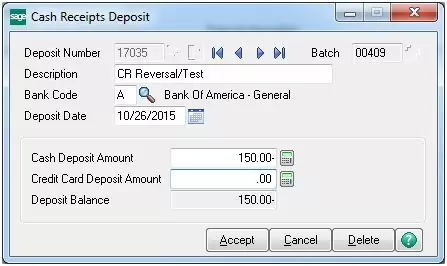

2) You will want to click on the cash receipts entry and then title the deposit as reference for the reversal. Be sure and enter a negative amount as the deposit amount.

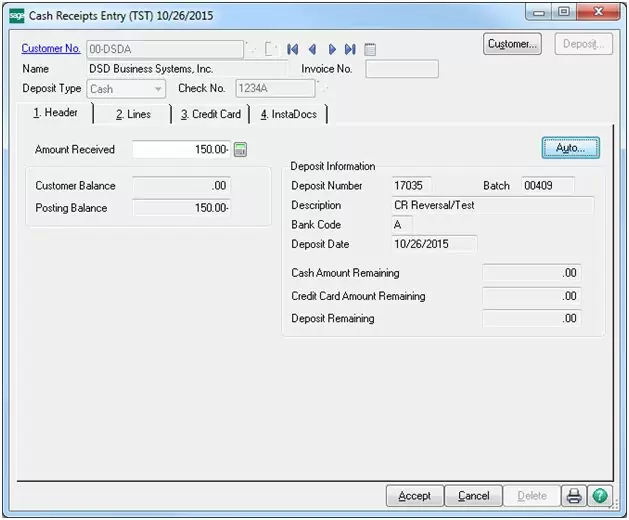

3) Once you hit accept on the deposit entry you will then be taken to the cash receipts entry screen where you will select the appropriate client. Note: For reference purposes it might be best to use the original check # you are reversing and add an “A” at the end.

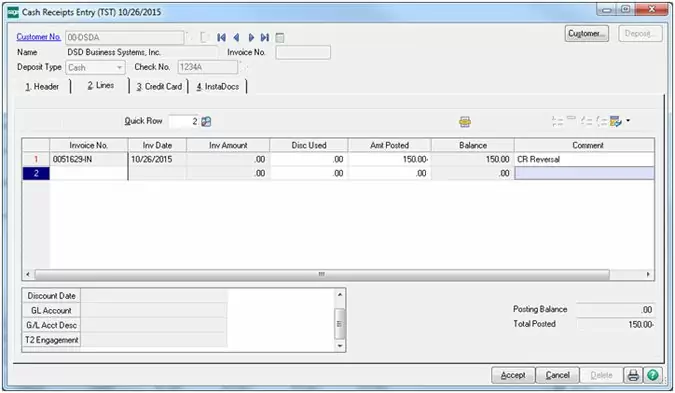

4) Once you hit accept you will be taken to the next screen where you select the invoice you are reversing the cash receipt from. On this section you have to physically type in the invoice number. Once you do that it will automatically populate the invoice with a negative amount to post which then give that invoice an actual balance amount.

5) Once you hit accept you can then update your cash receipts batch and print any registers or cash receipt journals for your records.

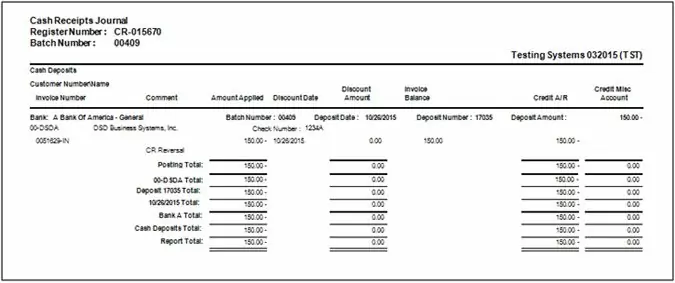

a) Cash Receipt Journal

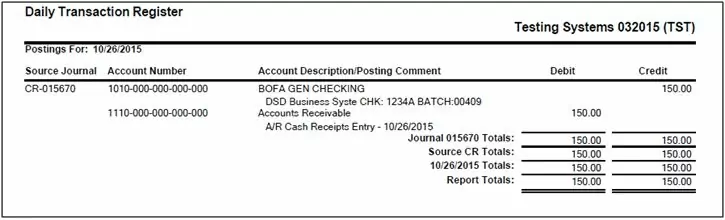

b) DTR (Daily Transaction Register)

6) After you update your journal and daily transaction register (DTR) it should update the customer record to now reflect a balance. The system will also update the appropriate General Ledger account that you originally used.

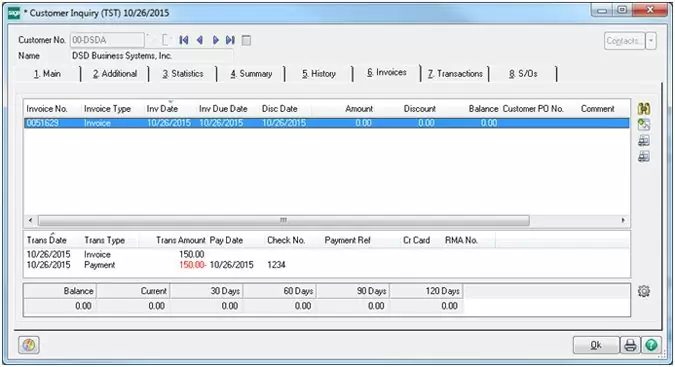

Before cash receipt reversal:

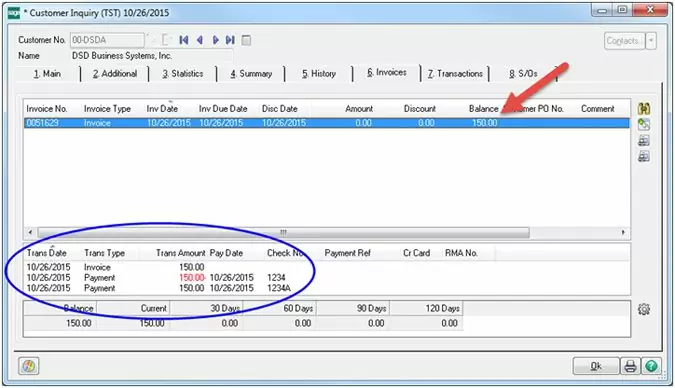

After cash receipt reversal:

The balance is back to the amount owed and you can see the transaction history applied appropriately.

I hope this has helped with reversing a transaction, once it’s been applied to an invoice. If you have any other questions about how to reverse a cash receipt in Sage 100, please feel free to contact DSD Business Systems.