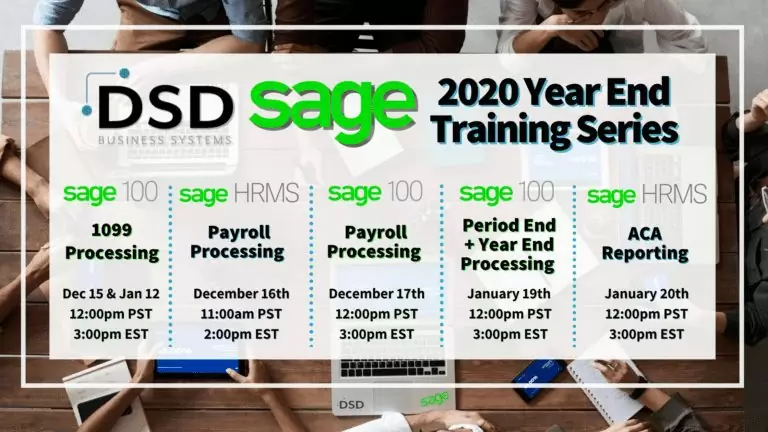

2020 Sage Year End Training Series Registration Now Open!

November 12, 2020

by Lindsey Byster, Digital Marketing Assistant

Now is the time to start planning so that the entire process will be smooth and stress free – and DSD wants to help by offering a series of training classes packed with process training and best practices for a successful year end close.

Join us for our Annual Sage Year End Training Series covering Year End Processing in Sage 100, Sage Payroll, Sage HRMS Payroll & Sage HRMS ACA reporting and MORE!

1099 Processing with Sage 100

Tuesday, December 15th @ 12pm / 3pm EST

Class highlights include:

- Overall IRS guidelines

- NEW 1099-NEC Form Considerations

- AP Data Processing Considerations

- Common 1099 Pitfalls

- Key Elements of Data Cleaning

- Confirming Data Accuracy

- Using the Aatrix connected service process offered in Sage 100

- Live Q&A with DSD Sage 100 Support

Sage HRMS Payroll Processing

Wednesday, December 16th @ 11am / 2pm EST

Class highlights include:

- New Regulatory Requirements

- Preparing for Year-End

- Earnings, Taxes & Deductions

- Transaction History

- Updating & Balancing the Quarter

- Creating Electronic Year-End Files

- Preparing for the New Year

- Year-End Checklist

- Q&A with DSD Sage HRMS Support

Sage 100 Payroll Processing

Thursday, December 17th @ 12pm / 3pm EST

- Important Year End Facts & Checklist

- Archiving Payroll Data

- Reporting Third Party Sick Pay on W-2

- W-2 Processing

- ACA Processing

- 2020 Pandemic Impact Scenarios

- COVID – Emergency Leave Overview

- Federal Tax credit for COVID wages

- EE Tax Deferral (Trump executive order)

- Q&A with DSD Sage 100 Support

1099 Processing with Sage 100

Tuesday, January 12th @ 12pm / 3pm EST

Class highlights include:

- Overall IRS guidelines

- NEW 1099-NEC Form Considerations

- AP Data Processing Considerations

- Common 1099 Pitfalls

- Key Elements of Data Cleaning

- Confirming Data Accuracy

- Using the Aatrix connected service process offered in Sage 100

- Live Q&A with DSD Sage 100 Support

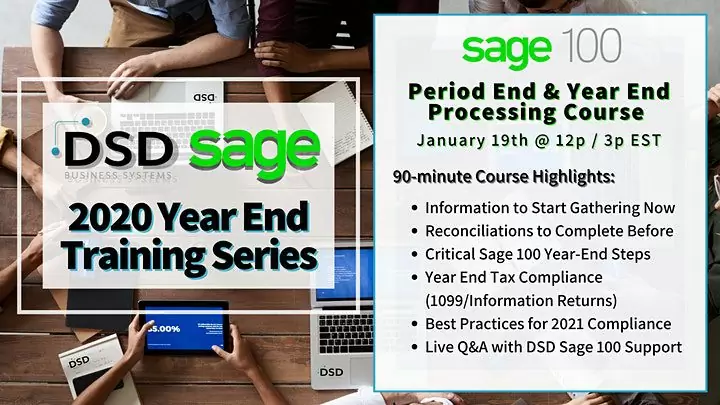

Sage 100 Period End & Year End Processing

Tuesday, January 19th @ 12pm / 3pm EST

Class highlights include:

- Information to Start Gathering Now

- Reconciliations to Complete Before

- Critical Sage 100 Year-End Steps

- Year End Tax Compliance (1099/Information Returns)

- Best Practices for 2021 Compliance

- Live Q&A with DSD Sage 100 Support

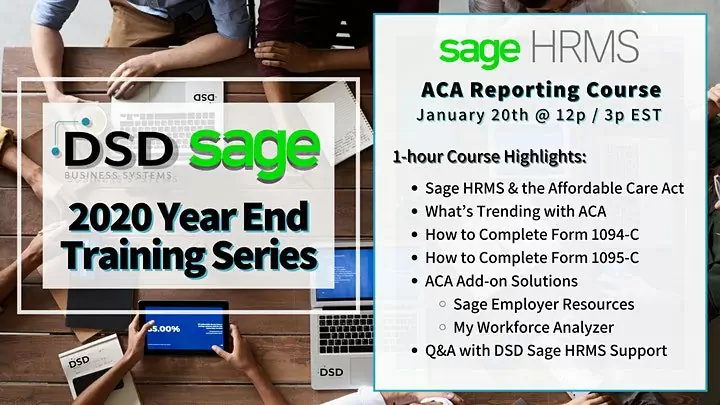

ACA Reporting with Sage HRMS

Wednesday, January 20th @ 12pm / 3pm EST

Class highlights include:

- Sage HRMS & the Affordable Care Act

- What’s Trending with ACA

- How to Complete Form 1094-C

- How to Complete Form 1095-C

- ACA Add-on Solution:

- Sage Employer Resources

- My Workforce Analyzer

- Q&A with DSD Sage HRMS Support

Save $49 when you bundle 3 Sage 100 OR 2 Sage HRMS courses together!

Purchase the bundled ticket and we’ll follow up to finalize the attendee registration for each event. Attend all courses or designate a single individual per course – the choice is yours!

Spots are limited so register today!