Sales Tax Nexus: What It Is and How Avalara Can Help

June 8, 2022

by Jared Bollier, Digital Marketing Analyst

Nexus is a crucial piece of the sales tax puzzle for any business, as it determines if, when, and where you’re required to collect and remit sales tax. Simply making a certain number of sales in a state, hiring a remote employee, or attending an event can be enough to trigger nexus. Avalara can help you keep track of your activities, so you aren’t hit with fines and other penalties.

What is sales tax nexus?

Sales tax nexus occurs when your business has some kind of connection to a state. Each state has its own definition of nexus, however most jurisdictions believe that a “physical presence” or “economic tie” establishes nexus. You are only required to collect sales tax in states where you have a sales tax nexus. Luckily, Avalara gives you a tax compliance perk that many other tax solutions don’t.

Nexus types: Physical vs. Economic

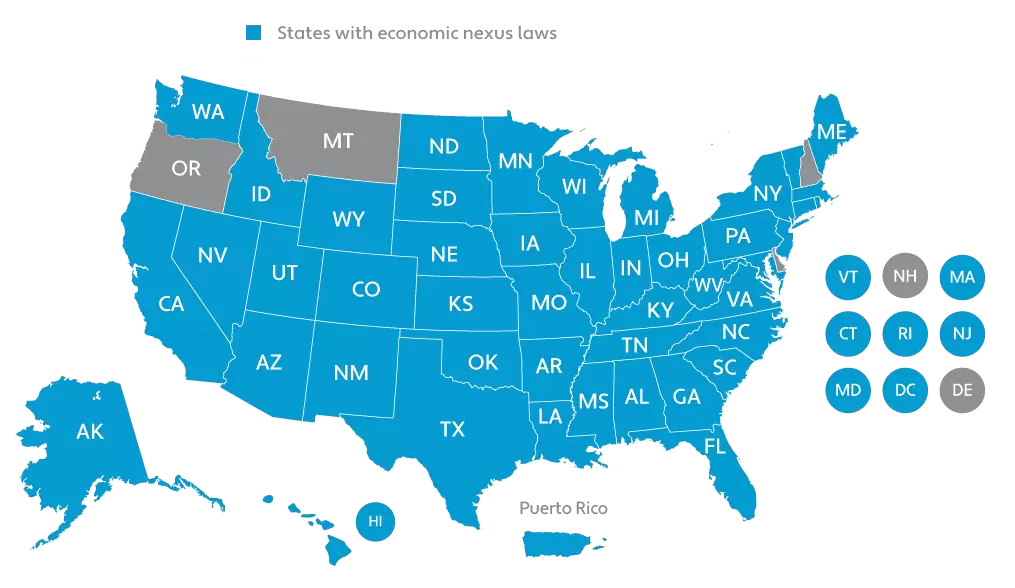

Economic Nexus

Economic nexus: Having a certain amount of sales and/or transactions in the state may give you an obligation to collect and remit sales or use tax in these states. In short, regardless of whether or not you have physical activities in a state, you may be required to register, collect, and remit sales and use tax there if you sell enough there.

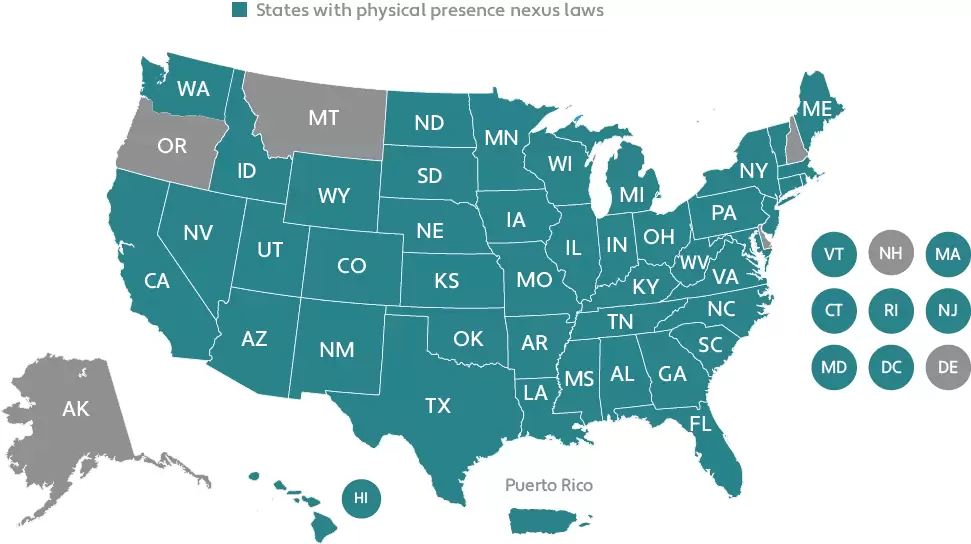

Physical Nexus

Physical presence nexus: Having employees, inventory, kiosks, offices, stores, trade show attendance, warehouses, or other physical ties to the state may give you an obligation to collect and remit sales tax in these states. The requirements for physical nexus vary per state.

Streamlined Sales Tax

More states are requiring firms to register to collect and submit sales tax as a result of recent remote sales tax legislation. If you’re one of them, the SST (Streamlined Sales Tax) may be able to help. SST is a state-funded initiative that makes it easier to register for sales tax and file returns. In up to 24 states, qualifying firms can utilize tax automation software for free. Consider how much time and money you might save on multi-state tax compliance with:

No Registration Fees

No Calculation Fees

No Preperation Fees

No filing & remittance fees

Unlike most tax solutions, Avalara is a certified SST-provider. For free, Avalara will handle all of your registration, filing and remittance, calculation, and preparation. They can also help save your organization time and money by automating all of your sales tax compliance-related activities in other states such as getting you registered where you need.

Nexus and the Sales Tax Puzzle

To help you better understand nexus laws and what’s required of you, we will be offering this educational session with the tax experts at Avalara. Join us Wednesday, June 23rd at 10 AM PST / 1 PM EST for Nexus and the Sales Tax Puzzle Presented by Avalara.

Together, we’ll walk through these key points:

- Nexus types: Physical vs. Economic

- The common activities that trigger each type of nexus

- A look at the different nexus thresholds by state

- Steps you can take to address any triggered nexus and how to get into compliance