Criterion HCM 2022 R3 Overview

November 8, 2022

Criterion HCM 2022 Release 3 is here and has lots to offer. This update brings new functionality, feature improvements, and new ways to use Criterion. Read on or watch the release recording to see the latest with payroll, employee usability, reports, and much more!

What's New in Criterion 2022 R3

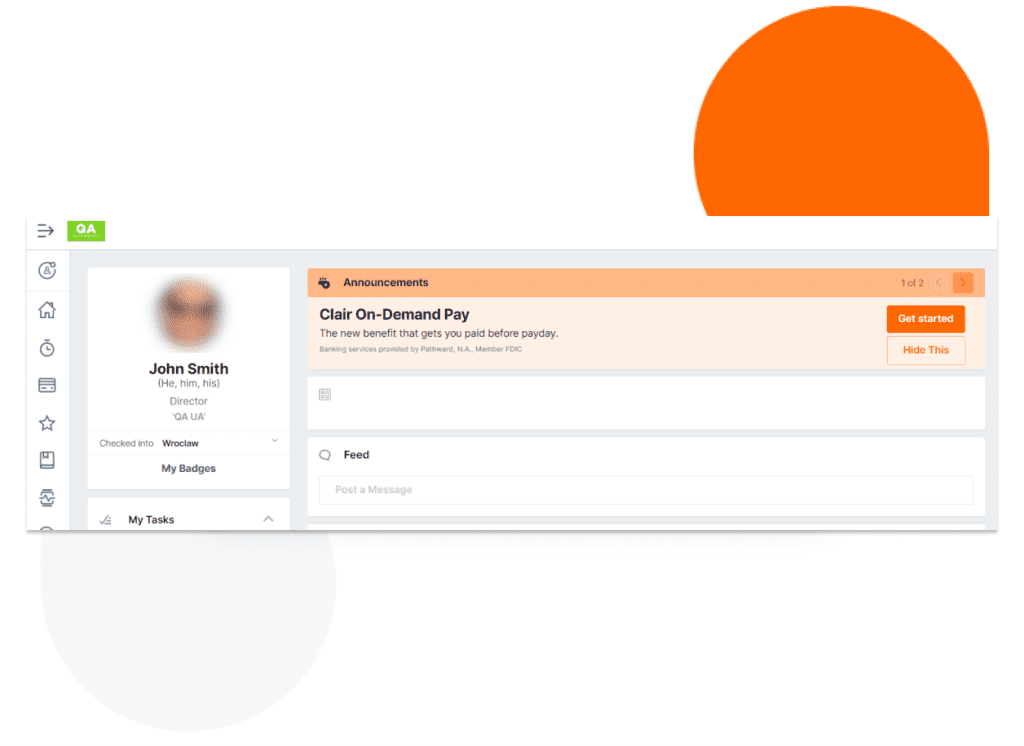

New Functionality in ESS

Now you won’t miss updates in the system! We can now display announcements for new functionality available at the top of the ESS Homepage.

If several announcements are displayed, you can move from one to the other using the arrow buttons. The Hide This button allows the user to hide announcements.

Data Grid Improvements

The following improvements have been implemented to the Data Grid functionality:

1. Now you can retrieve employee data within other modules where applicable. You can add employee columns from the Employees Module in any other Module that has the Employee ID column.

2. Now you can add columns from the Employees Assignments Module in Assignments Custom Values Module.

3. We have added the operator selection to the column settings

- The “And” operator creates a new criterion in the last group

- The “Or” operator creates a new group of criteria and a new criterion in it

- A user is able to move the selected filters by using drag and drop

Payroll: New Formula for Monthly Guarantee Income

A new formula – MONTHLY_GUARANTEE(value,label) – is available for incomes of the Formula type. This new formula will be applied during the payroll processing and will guarantee the minimum monthly gross amount to the employee.

The formula is used for Monthly and Semi-Monthly payroll periods.

The MONTHLY_GUARANTEE(value, label) can be set up at the income and/or employee level as follows:

1. In the income code settings using MONTHLY_GUARANTEE(3000)

2. Including an optional system label to include incomes in the guarantee such as MONTHLY_GUARANTEE(3000, “MY_INCOME_LABEL”)

3. Overriding at the employee level is also possible if a value is entered on the employee income screen. Employees can see their monthly guarantee value in ESS.

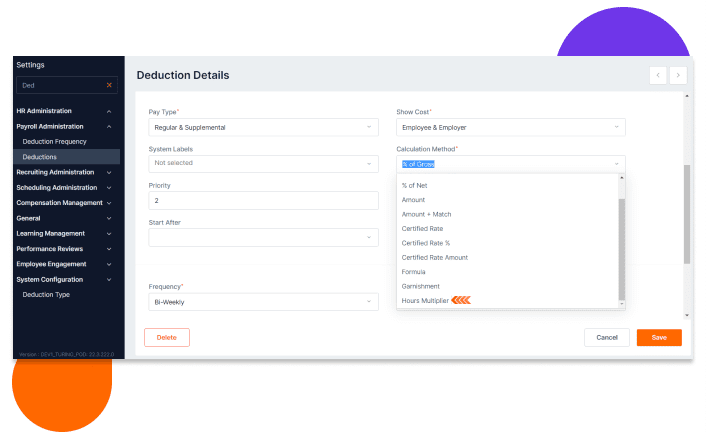

Payroll: New Deduction Calculation Method Added

A new Hours Multiplier calculation method has been added to deductions.

Under HR > Settings > Deductions, you can find the Hours Multiplier calculation method in the Calculation Method drop-down list. This method multiplies the hours for all hourly incomes linked to the deduction using a system label by a specified rate per hour.

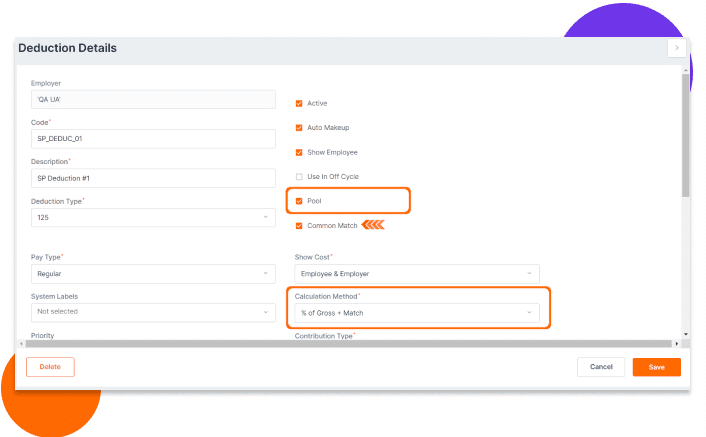

Payroll: Common Match Option for Different Deductions

The deduction settings have been improved:

- For deductions with the % of Gross + Match calculation method, if Pool is turned on, and the Parent deduction is selected, the Common Match option is available to enable evaluating different deductions against the maximum employer match.

Payroll: LIFETIME Deduction Limit Calculation Updated

LIFETIME limits of deductions will now be calculated within the date range of the deduction.

Payroll: Commissions and Commission Plans

Criterion can now calculate commissions imported into the system and approved using a new workflow that has been added. Commission Plan are configurable in a new setting under Payroll Administration named Commission Plans. Commission plans allow for default commission rates as well as Tiers for commissions for different groups of employees.

Employees can view their commissions in ESS as well as manager can view their Team Commissions in ESS.

Payroll: Advanced Support for 1099 Report

Criterion now supports the 1099-MISC, 1099-NEC forms, and 1096 reports.

In this release, a new setting under Employer enables 1099 reporting. When enabled, a Payroll Administrator can select the type of Payroll batch when beginning a payroll cycle. If the Payroll Batch type is set to “Regular”, it will be included in the reports W-2, 941, and others. If the Payroll Batch type you select is different from “Regular”, the batch will be included into the corresponding reports.

By default, all batches have Regular type.

Payroll: Minimum Wage Calculation Method

There is a new calculation method available in the Income settings – Minimum Wage.

This calculation method allows calculating income rates for regular and overtime hours at minimum wage when processing payroll.

We now support calculating US Dept of Labor Section 7i OT exemption for commission employees of retail and service establishments.

Employees: Secondary Assignments for Dynamic Employee Groups

For dynamic employee groups, we now allow including secondary assignments.

A toggle has been added to the Employee Group settings. You can enable it to include secondary assignments to the group.

Employee Termination: Updates in Deduction Termination

When performing employee termination, you can now expire deductions.

In the termination widget, the list displays deductions that are not linked to benefits. The expiration date can be set to the termination or different date.

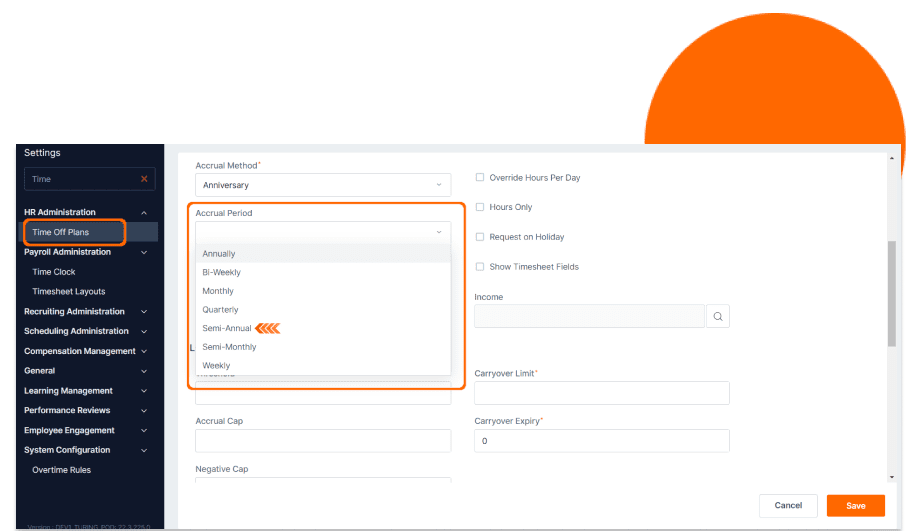

Time Off Plans: Semi-Annual Accruals

For time off plan periods, you can select a Semi-Annual option. This option allows time off plans that would accrue 2 times per year.

Time Off Plans: Income Formula Added

For income with the type Formula+Hourly the new formulas have been added:

- “AVERAGE_PAYROLL_RATE(pay_periods)” where pay_periods is the number of previous pay periods that should be taken in the calculation, e.g. “AVERAGE_PAYROLL_RATE(6)”.

- “CURRENT_HOURLY_RATE” – Returns the latest active primary hourly rate in the payroll period.

This allows an Administrator to set up the Income Formula in time off plan equal to “AVERAGE_PAYROLL_RATE(6) – CURRENT_HOURLY_RATE” so that previous payroll data could be included in the rate calculation.

Time Off Requests: Button Position Improved

In ESS, on the adding time off screen, the positions of buttons are improved.

Instead of separating the Save and the Submit buttons at opposite sides of the bottom panel you can see the Submit button to the right with the drop-down for Save.

Reports: Improvements in Job Posting Summary Report

The Job Posting Summary Report now includes the number of candidates with various statuses.

The Job Posting Summary Report now includes the number of candidates with various statuses.

Expense Reports: Setting Up Project & Tasks per Individual Expenses

For Expense reports, you can now define the Project and Task for individual expenses. Now you can find these fields when adding expenses to the report at Employee Profile > Payroll > Expense Reports > Add Expenses at report details.

Projects: Adding Task To Multiple Projects

Tasks can now be assigned to more than one project. Under Projects when adding Tasks a new toggle is available Show Assigned, when enabled administrators can select tasks that have already been assigned to other projects. In the task list at Settings, you can see the list of projects the task belongs to.

Projects: Overtime Rules At Project Level

Now a user can set up overtime rules for a project via an Overtime code in Project settings.

Timesheets: Piece Work & Displaying More Details

Sub-Project, Sub-Task, Piece, and Percent Completed fields can now be displayed in timesheets.

Under Projects you can now add Sub-Project.

Under Tasks you can now add Sub-Task.

A new setting named Piece Rates is now available under Payroll Settings which allows an Administrator to add Pieces and Rates to the system for use on the timecard and to calculate pay based on the percentage of the piece completed by the employee.

If the Calculation Method in Income settings is set to Units, a new Use Rate Table checkbox is available. If it is checked, the Rate field is not displayed on the screen and payroll will use the rate from the Piece Rate table.

Timesheets: Setting Up Required Fields

Now we allow making the fields in Timesheet Layouts required. You can select which fields to make required at Settings > Timesheet Layouts > Text Labels/Label Enable.

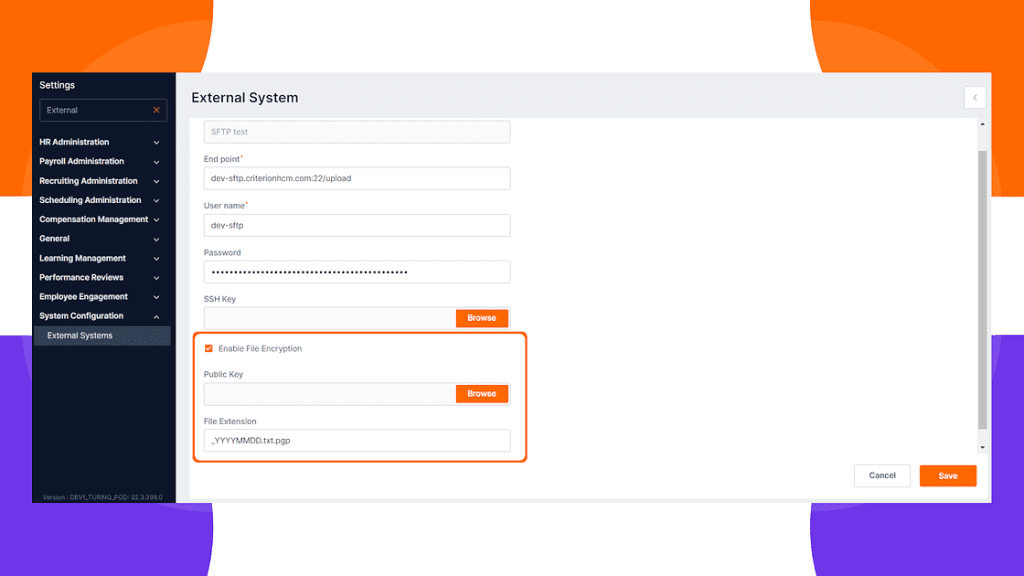

PGP Encryption for Сarrier Сonnection File Submission

Criterion sends Benefits data to carriers. Some carriers require encrypting files using a provided PGP Key before submitting the resulting file. This encryption can be enabled in External System settings.

If enabled for SFTP connections, you can fill out the Public Key and define the extension of the file (.pgp is the default extension).

Work Location: Setting Up Minimum Wage

In Work Location settings, you can set the minimum wage for the specific work location. When importing payroll it is compared with the assignment pay rate. If the pay rate is lower than the minimum wage, the minimum wage is used.

Open Enrollment: Selecting a Reason for Waiving a Benefit

You can now require that an employee selects a waive reason when completing Open Enrollment. A new check box has been added to the Open Enrollment Steps Waive Reason Required. If checked, during enrollment a drop-down field to select a waive reason is displayed when an employee selects Waive.

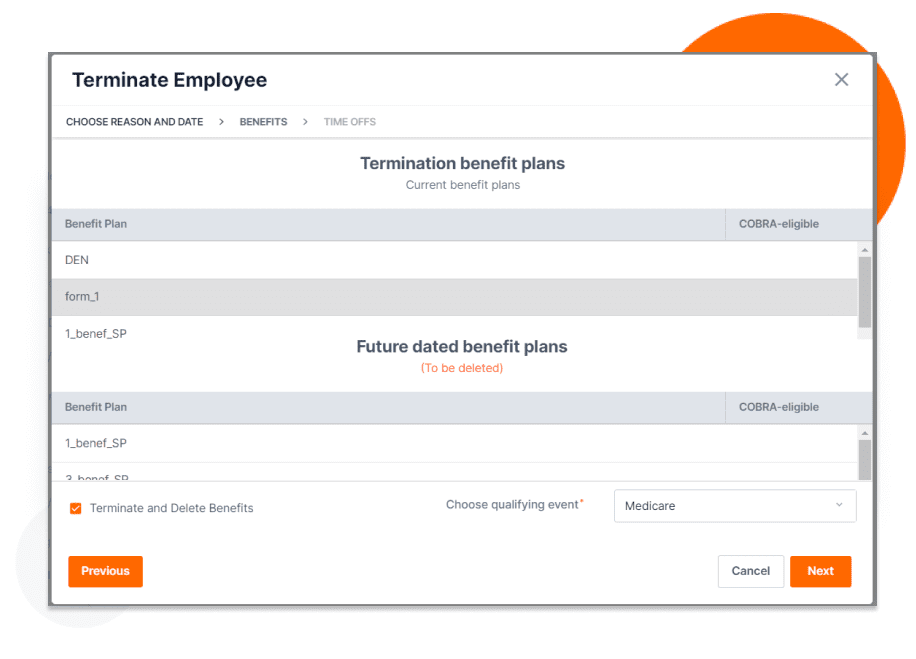

Benefits: Deleting Future-Dated Benefits at Employee Termination

During the Employee termination process, on the Terminate Benefits screen, an employee can see the future-dated benefits. The employee can enable the Terminate and Delete Benefits option. If enabled, the current benefits will be terminated, and the future-dated benefits will be deleted.

Apps: Pest Pac Importing App Added

We have added the Pest Pac app. It is available for you to import time cards from Pest Pac and track time, activities, and commissions.

Database Changes

The updates to the database performed under Release 22.3 are presented on the Database Changes page.