Sage Intacct 2022 R4: Highlights, Demos, and More!

November 16, 2022

Sage Intacct 2022 Release 4 is here and has tons of great highlights that we’re excited for. Sage Intacct Payroll powered by ADP, Expanded Support for Nonprofits, and Sage Intacct Lease Accounting are just some of the notable updates that come in this new release. Read on to get more details on the latest features, see demos, and get the full release notes.

Best-in-class Financials Highlights

SEPA bank file payments

Bank files are now more robust and flexible to support your unique business needs. You can now pay vendors in Ireland and France with the SEPA bank file format.

Bank files support payments between accounts that use the same currency. For example, you can pay a French vendor from an Irish bank account because both use EUR currency.

Statistical account data and grid entry in Sage Intacct Planning

Two of the most requested Sage Intacct Planning features are now available!

- Grid entry provides the look and feel of a spreadsheet, making data entry a snap.

- Import statistical account data from Sage Intacct into Planning for improved data entry flexibility.

1099 e-filing powered by TaxBandits—Coming Soon

Seamlessly integrate your 1099 information with TaxBandits, an IRS-authorized e-filing provider. Eliminate manual printing and alignment issues and file your tax forms electronically.

Industry highlights

Sage Intelligent Time — Expanded support for nonprofits

Sage Intelligent Time is now available with grant tracking for nonprofit organizations.

- Empower program staff to focus on project delivery instead of time-capture.

- Automate the capture of reimbursable time with down-to-the minute precision.

- Receive electronic statements of time spent to satisfy single-audit requirements.

Sage Estimating (SQL) integration w/ Sage Intacct Construction

Take advantage of the power of industry-leading Sage Estimating to quickly create accurate estimates and export them directly to Sage Intacct. With this integration, there’s no need to re-enter data.

Sage Intacct Lease Accounting — Early Adopter

Introducing lessee-side lease tracking and accounting automation for operating leases with the latest ASC 842 and IFRS 16 standards.

- Centralize and manage lease contracts.

- Automate accounting recognition.

- Tie lease liabilities to right-of-use assets.

- Ensure compliance with updated accounting standards.

Compliance Highlights

Compliance documentation

Sage Intacct is designed with compliance in mind. Access information in the Help Center to understand audit considerations and configuration options that ensure trusted financial reporting.

Leveraging experience from global audit experts, Sage outlines key compliance areas and include best practices and ways to identify preventative and detective control options.

Training Highlights

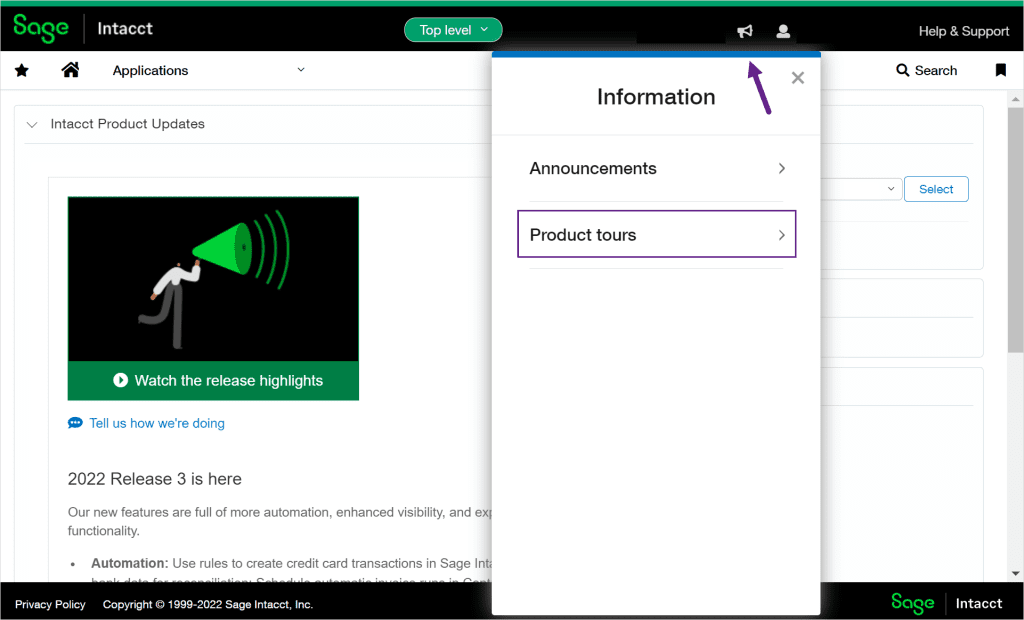

Embedded training

This release Sage added a welcome tour for new users, along with feature walk-throughs to help you get the most out of your Sage Intacct experience.

And Much more!

For all the specifics, in-depth descriptions, and demonstration videos of the improvements coming to the product, see the complete comprehensive list of changes made in Sage Intacct 2022 Release 4.