Sage 100 Payroll and 1099 Compatibility Change for 2023

October 12, 2023

by Jared Bollier, Digital Marketing Analyst

Due to compatibility issues with the latest software provided by Sage’s tax reporting partner Aatrix, the Sage 100 Payroll 2.24 release and 1099 update scheduled for December of this year will not be compatible with versions of Sage 100 prior to 2020 (6.20.0). Specifically, payroll customers and those utilizing 1099 functionality running Sage 100 versions 2018 and 2019 must upgrade to a supported version of Sage 100 to install the Payroll 2.24 release and the latest tax form updates.

Effective with the release of Payroll 2.24, payroll and 1099 customers on versions 2018 and 2019 will need to be running one of the following versions of Sage 100 to install the latest release of Payroll and 1099 forms:

Sage 100 Versions 2020.X, 2021.X, 2022.X, 2023.X

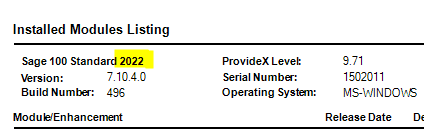

How to find what version you're on

To determine what version of Sage 100 you are running, preview the Sage 100 Installed Modules Listing found under Library Master>Reports>Installed Modules. See below for the highlighted version.

If your current version is 2018 or 2019 contact your DSD Account Manager or Contact Support immediately to schedule your upgrade to be completed to process your 1099’s, W-2’s, 1095’s, and other payroll tax forms for 2023.

Frequently Asked Questions

Who is impacted?

Sage 100 payroll customers and those using 1099 functionality that are currently running versions 2018 and 2019.

Important Note: Customers running unsupported legacy Payroll versions do not have the option of a separate Payroll installation and are not impacted by this change.

When will we experience an impact?

Upon the release of Sage 100 Payroll 2.24 and the update of forms for reporting year 2022, scheduled for release in December 2023.

Payroll customers and those installing updated 1099 forms that are still running Sage 100 versions 2018 and 2019 upon the release of Payroll 2.24 will be impacted.

What version of Sage 100 should we be running to avoid an impact?

Sage 100 versions:

• 2023.x

• 2022.x

• 2021.x

What issues will we experience if we have not upgraded by the release of Payroll 2.24?

Customers not running a compatible version of Sage 100 will experience:

• A failure of the Payroll update installation.

• The inability to generate 1099’s, W-2’s or associated tax reporting documents.

Will customers be required to continue to update their Sage 100 software to use the Payroll module without interruption?

Starting with our 2024 Payroll release we will have an n-3 support policy for payroll updates, meaning the update will be compatible with the latest and three prior versions of the Sage 100 software.

Therefore, it will be important for customers on versions of Sage 100 2018 and up to remain current moving forward.

Why is this happening now?

Due to security enhancements in the latest builds from our tax form and filing provider (Aatrix), we have found that we can no longer support Sage 100 versions 2018 and 2019 with the latest Payroll software and forms.

Why aren’t users on Sage 100 versions released before 2018 impacted?

Sage 100 version 2018 was the first release that experienced having Payroll split from the core Sage 100 product.

We have since enjoyed the ability to continually update the Payroll module while allowing customers to be on legacy versions of Sage 100.

Customers running unsupported legacy Payroll versions do not have the option of a separate Payroll installation and therefore are not impacted by this change.

Looking to Learn More?

If you’re looking for more information or training on Sage 100 Payroll processing, registration for the DSD Sage 100 2023 Year-End Training Series is now open! Early Bird course price is only $50 until November 30th so register now!

DSD SLA Clients should request a special promo code to redeem training credits.

Sage 100 Payroll Processing Course

December 14th | 11 AM PT / 2 PM ET

– Year End Processing Requirements

– Tips & Tricks & FAQs

– Year End Checklist

– Reporting Third Party Sick on W2’s

– W-2 Processing & ACA Processing