How to Solve the Minnesota Delivery Fee Issue in Sage 100

June 26, 2024

Two years after successfully implementing a solution for Colorado’s delivery fee, we’re ready to tackle Minnesota’s new $0.50 Retail Delivery Fee starting July 1, 2024. Our proven product seamlessly manages these fees and prepares businesses for similar future regulations.

Retailers must collect the $0.50 fee on deliveries of taxable goods to a Minnesota address when the total amount of the transaction is $100 or more. The retail fee applies to retailers selling taxable tangible goods for delivery by motor vehicle to Minnesota consumers, regardless of who owns or operates the vehicle used for delivery, and whether the delivery originates in Minnesota or another state. Retailers must separately state the retail delivery fee on all customer invoices and receipts as “road improvement and food delivery fee.” Note: The retail fee is levied on all qualifying deliveries, even when shipping is free.

Exceptions: The retail fee doesn’t apply to deliveries of food, prescription drugs, medical supplies/devices, and certain baby products. It also doesn’t apply to sales that take place at the retailer’s business location, such as curbside delivery.

Retailers with less than $1 million in sales in the previous calendar year are exempt. Marketplace providers facilitating sales for retailers with less than $100,000 in marketplace sales in the previous year are also exempt. The fee doesn’t apply when otherwise taxable goods are delivered to a purchaser that is exempt from state sales tax, such as a government or charitable organization.

How can you easily handle the Minnesota Retail Delivery Fee in Sage 100?

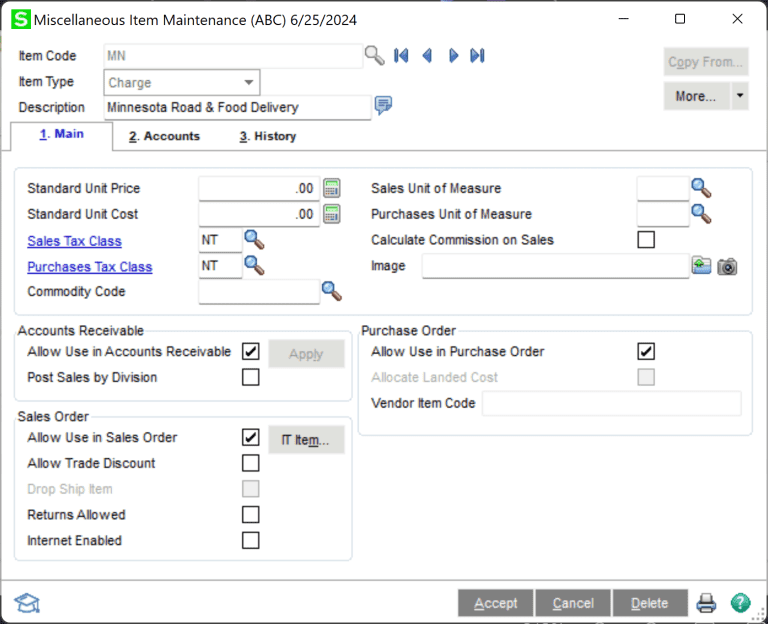

Option 1: Use a Miscellaneous Charge line item

Set up a new Miscellaneous Charge defaulting to $0.50. Manually add this charge to Sales Orders or S/O Invoices for Minnesota Ship-To Addresses with at least one taxable line item and a total transaction amount of $100 or more. Assign the Revenue Account to a new account specific to the Minnesota Retail Delivery Fee for easy reporting.

Option 2: Use a new Sales Tax Code

This will automatically calculate the $0.50 fee for Order/Invoice. Only use this Tax Schedule if the Taxable Amount for the Order/Invoice is $100 or more.

Option 3: Use AvaTax to add the Retail Delivery Fee to the Tax Amount

Set up a Miscellaneous Charge with a specific Tax Code (consult AvaTax for the correct code). Set the default charge to $0.00. AvaTax should have a built-in tax rule to add the $0.50 fee to qualifying transactions.

NOTE: If the total transaction amount is less than $100, ensure the Miscellaneous Charge is not applied.

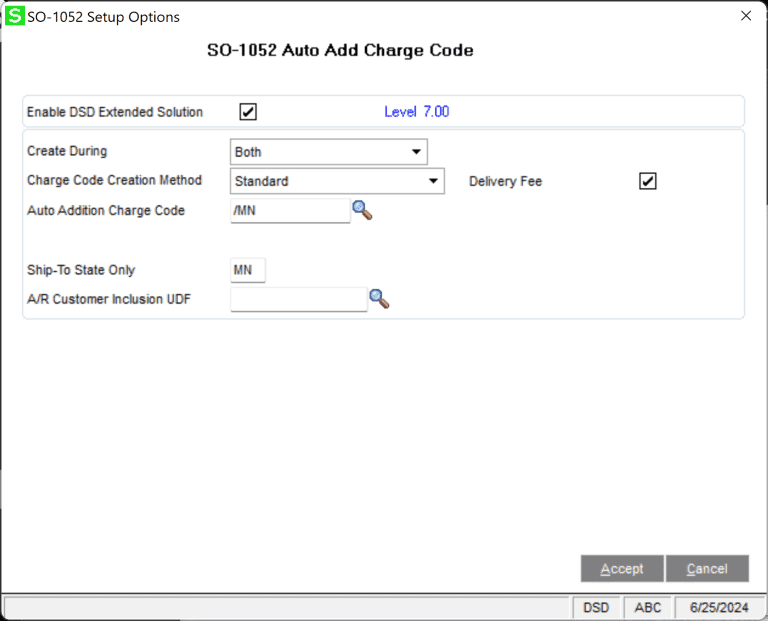

Option 4: Use DSD Extended Solution SO-1052 Automatic Addition of Miscellaneous Item

Set up a Miscellaneous Charge for the Minnesota Retail Delivery Fee. The solution can automatically add this charge to Orders/Invoices if (1) there is a Taxable Amount of $100 or more, and (2) The Ship to State is “MN”. It should also remove the charge if the Taxable Amount falls below $100 or the Ship to State changes. If using AvaTax, set the Miscellaneous Charge default to $0.00 so AvaTax handles the Retail Delivery Fee as a tax.

Which Option is best?

For businesses grappling with the complexities of state-specific retail delivery fees, DSD enhancement SO-1052 Automatic Addition of Miscellaneous Item emerges as the go-to solution. This powerful tool has proven its worth with the Minnesota Retail Delivery Fee and is primed to tackle Minnesota’s upcoming retail fee, as well as any future state mandates. SO-1052 offers unparalleled automation, flexibility, and accuracy, ensuring long-term compliance and operational efficiency.

By adopting this enhancement, companies can confidently navigate the evolving landscape of retail delivery fees, allowing them to focus on core business activities while seamlessly maintaining regulatory adherence in Sage 100. Also, SO-1052 can be integrated with the AvaTax solution for a complete solution!

For more information on SO-1052 Automatic Addition of Miscellaneous Item, please visit the SO-1052 Product Page.