Coronavirus Tax Relief: How Governments are Supporting Businesses amid the COVID-19 Pandemic

March 25, 2020

by Kimberly Tucker, Director, Marketing

As the COVID-19 fight continues and policies are put in place to mitigate the spread globally, businesses across all industries have been encouraged or even forced to suspend operations and change operations entirely to stop the opportunity for spread.

With such an unexpected and unprecedented economic impact, Governments worldwide are working tirelessly to uncover the best way to offer assistance to all organizations who have been negatively impacted.

In some countries, that involves tax filing and payment extensions and even temporary rate reductions. Other nations, including the United States, are just beginning to respond.

While these are still uncertain times, Avalara wants to help bring clarity to a somewhat hazy situation by providing information on the tax relief options available to those affected.

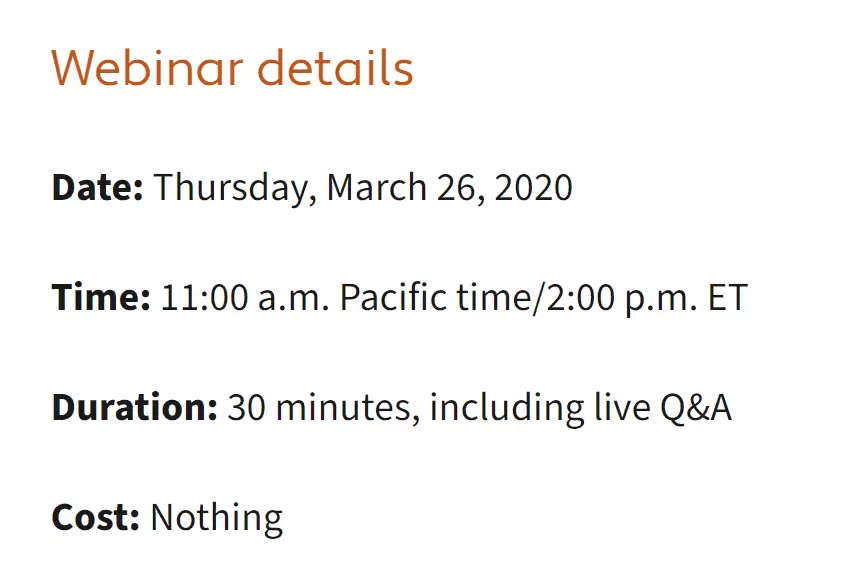

Join us for a 30-minute Q&A session with Avalara Senior Staff Writer Gail Cole to learn about the latest on these rapidly changing efforts.

Can't make it to the webinar?

Rather than make you hunt for information, Avalara has created a “Covid-19 Tax Relief Roundup” post that compiles tax news related to the COVID-19 outbreak and is updated regularly as more information becomes available.

Avalara VP of Global Affairs Richard Asquith has his finger on the pulse of global coronavirus-related tax relief. has his finger on the pulse of global coronavirus-related tax relief from a global perspective. For the latest international tax news related to the outbreak, see the post titled “World turns to VAT cuts on coronavirus Covid-19 threat“ and Avarlara’s VATlive blog.