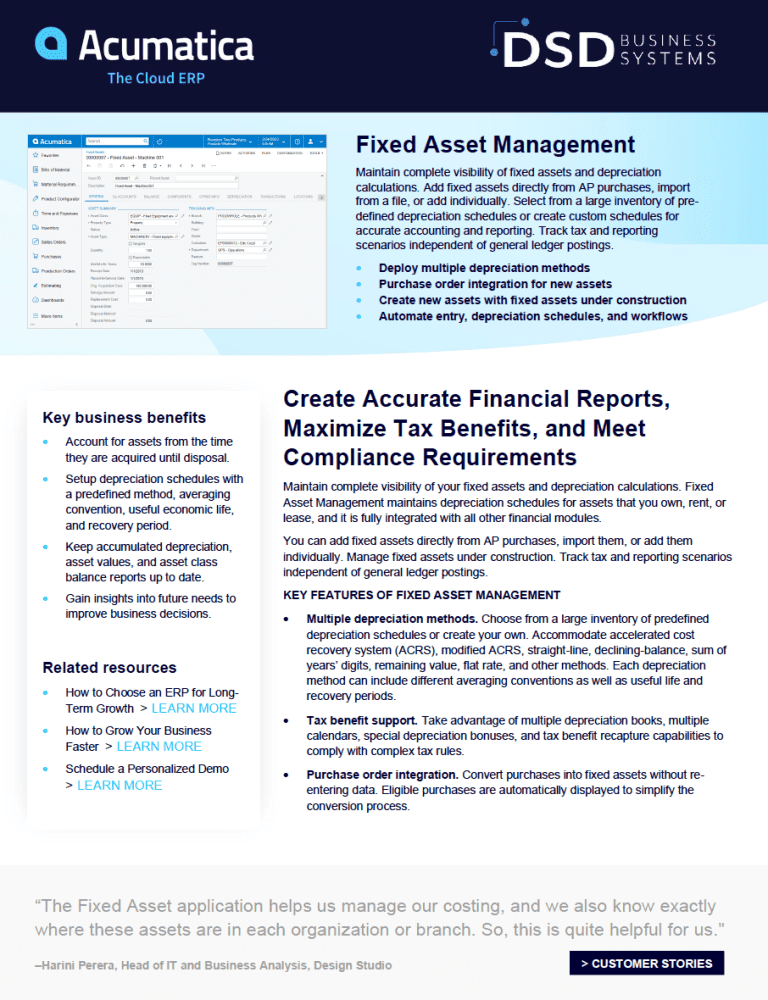

In this Acumatica Fixed Asset Management Datasheet, learn how Acumatica can help maintain complete visibility of fixed assets and depreciation calculations. Add fixed assets directly from AP purchases, import from a file, or add individually. Select from a large inventory of predefined depreciation schedules or create custom schedules for accurate accounting and reporting. Track tax and reporting scenarios independent of general ledger postings.

Maintain complete visibility of your fixed assets and depreciation calculations. Fixed Asset Management maintains depreciation schedules for assets that you own, rent, or lease, and it is fully integrated with all other financial modules.

You can add fixed assets directly from AP purchases, import them, or add them individually. Manage fixed assets under construction. Track tax and reporting scenarios independent of general ledger postings.

Key Features in Fixed Asset Management Datasheet: