Sage Fixed Assets: Transform Your Depreciation Management Efforts

September 26, 2024

Why Fixed Asset Management Matters

In today’s complex business landscape, effective fixed asset management is not just a necessity—it’s a strategic advantage. Proper handling of fixed assets can significantly impact a company’s financial statements, tax liabilities, and overall fiscal health.

Enter Sage Fixed Assets, a comprehensive solution designed to transform the way businesses manage their valuable assets. Fixed assets often represent a substantial portion of a company’s total assets.

Mismanagement can lead to:

Inaccurate financial reporting

Overpayment of taxes and insurance

Compliance issues with regulatory bodies

Inefficient resource allocation

Sage Fixed Assets addresses these challenges head-on, offering a suite of tools that bring precision, compliance, and efficiency to fixed asset management.

The Sage Fixed Assets Advantage

Sage Fixed Assets isn’t just software—it’s a complete asset management ecosystem. It offers:

Accuracy

Eliminate errors common in manual asset tracking and depreciation calculations.

Compliance

Stay up-to-date with ever-changing tax laws and accounting standards.

Efficiency

Automate time-consuming processes, freeing up resources for strategic initiatives.

Insights

Gain valuable visibility into your asset portfolio for informed decision-making.

Sage Fixed Assets: Revolutionizing Depreciation Management

At the core of Sage Fixed Assets lies its powerful Depreciation module, designed to streamline and automate the complex process of asset depreciation. This module offers unparalleled flexibility and accuracy, ensuring your business stays compliant while maximizing tax benefits.

Key Features:

Powerful Calculation Engine

The module incorporates over 300,000 IRS tax rules, providing unmatched accuracy in depreciation calculations and helping navigate complex tax regulations.

Flexible Asset Lifecycle Management

From Acquisition to disposal, the Depreciation module allows you to manage every stage of your fixed assets’ lifecycle within a single, intuitive interface.

Comprehensive Depreciation Methods

With over 50 depreciation methods available, including MACRS, ACRS, and Straight-Line, the module ensures you can apply the most appropriate method for each asset.

Why Chooose Sage Fixed Assets Depreciation?

1. Compliance Assurance:

Stay up-to-date with the latest IRS regulations and GAAP standards.

2. Time and Cost Savings:

Automate complex calculations and reduce manual data entry.

3. Accuracy:

Minimize errors associated with spreadsheet-based asset management.

4. Scalability:

Suitable for businesses of all sizes, from small enterprises to large corporations.

Take Control of Your Fixed Assets Today

Don’t let outdated methods and complex regulations hinder your financial accuracy. Sage Fixed Assets and its powerful Depreciation module offer a streamlined solution for modern asset management.

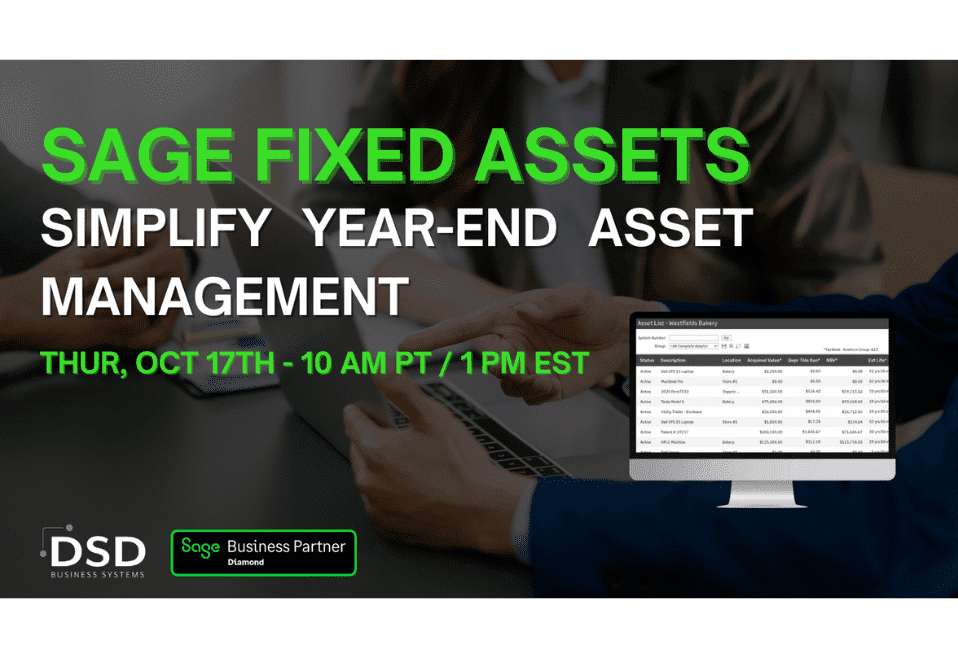

Want to learn more? Register for our upcoming webinar, to discover how to save time, reduce errors, and ensure compliance. Join us to see firsthand how Sage Fixed Assets can transform your approach to asset management. Reserve your spot now and take the first step towards enhanced financial accuracy and peace of mind.