2024 DSD Sage Year-End Training Series: Get Ready for Success!

November 6, 2024

As we approach the end of 2024, it’s time to prepare for the DSD Sage Year-End Training Series! This year, we are excited to offer a comprehensive lineup of training sessions designed to help you navigate the complexities of year-end processing with Sage 100. Whether you’re managing 1099s, payroll, or period-end reporting, our expert-led courses will equip you with the knowledge and skills needed for a smooth year-end close.

Our training series is meticulously crafted to cover essential aspects of year-end processing in Sage 100. Here’s a detailed look at what each course offers:

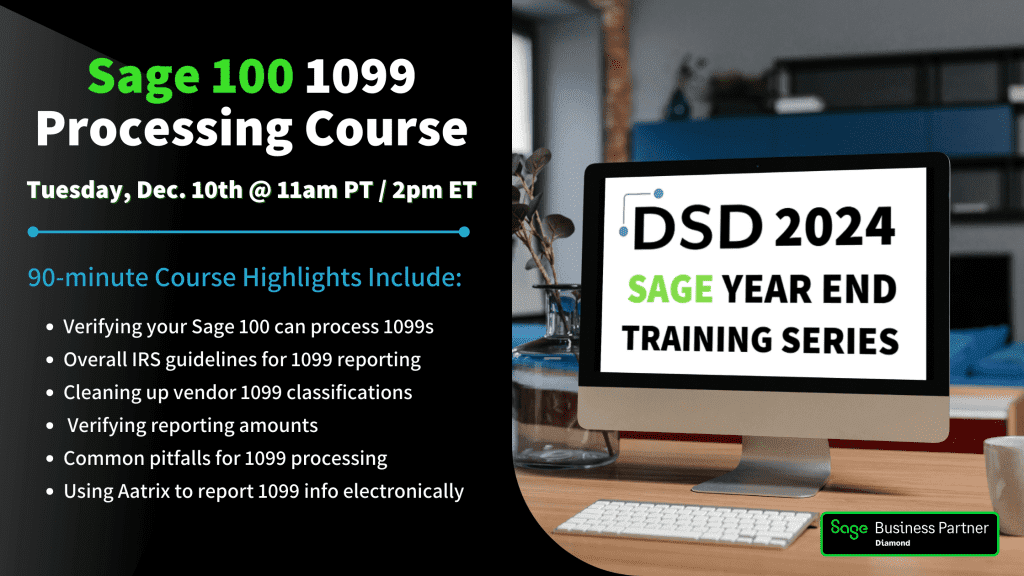

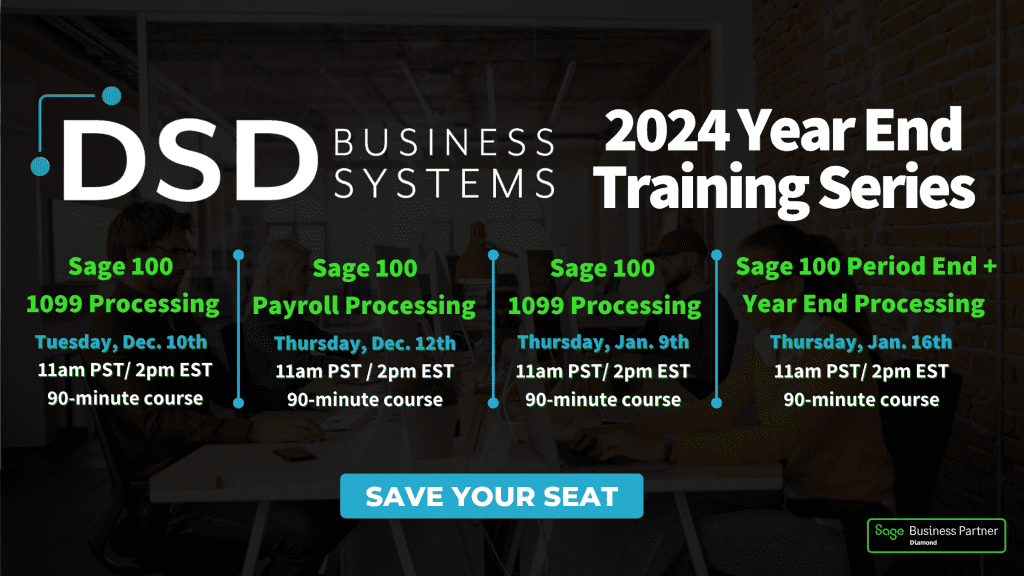

Sage 100 1099 Processing Course

Tuesday, Dec. 10th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Verify that your version of Sage 100 can process 1099s for 2024

- Overall IRS guidelines for 1099 reporting

- Cleaning up vendor 1099 classifications and verifying reporting amounts

- Common pitfalls for 1099 processing

- Using Aatrix in Sage 100 to report 1099 information electronically

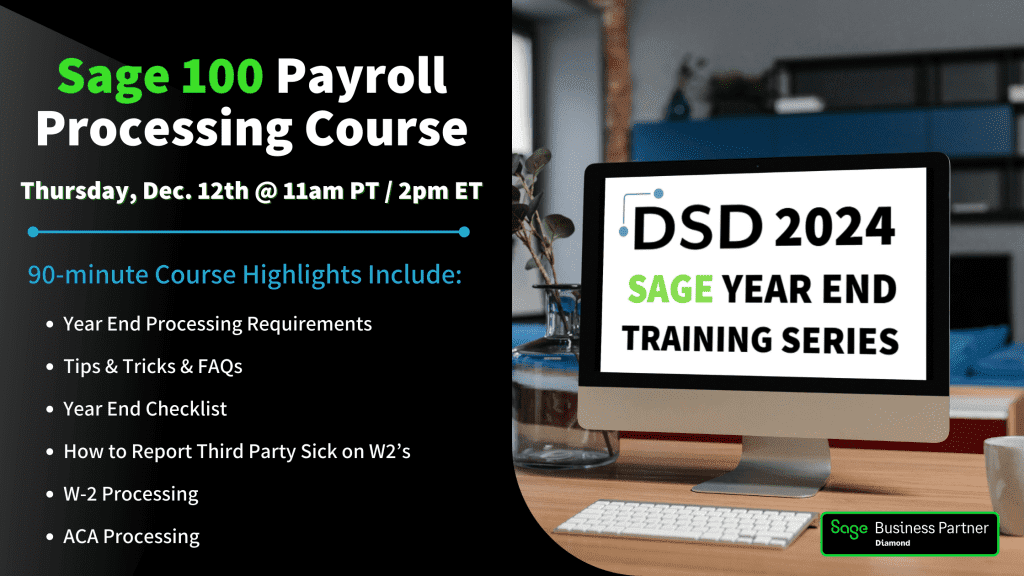

Sage 100 Payroll Processing Course

Thursday, Dec. 12th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Year End Processing Requirements

- Tips & Tricks & FAQs

- Year End Checklist

- How to Report Third Party Sick on W2’s

- W-2 Processing

- ACA Processing

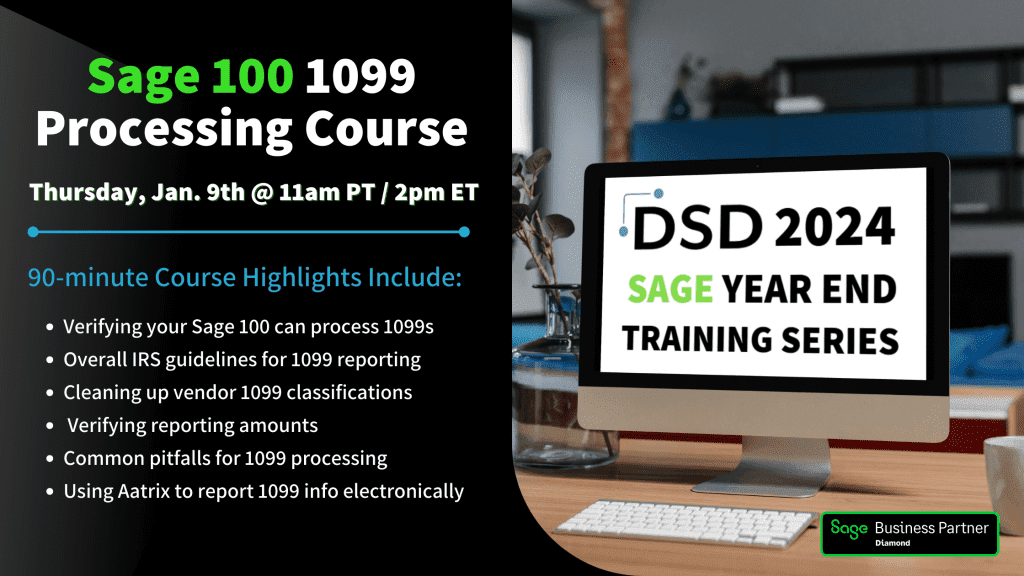

Sage 100 1099 Processing Course (Repeat)

Thursday, Jan. 9th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Verify that your version of Sage 100 can process 1099s for 2024

- Changes to 1099 boxes for 2024

- Overall IRS guidelines for 1099 reporting

- Cleaning up vendor 1099 classifications and verifying reporting amounts

- Common pitfalls for 1099 processing

- Using Aatrix in Sage 100 to report 1099 information electronically

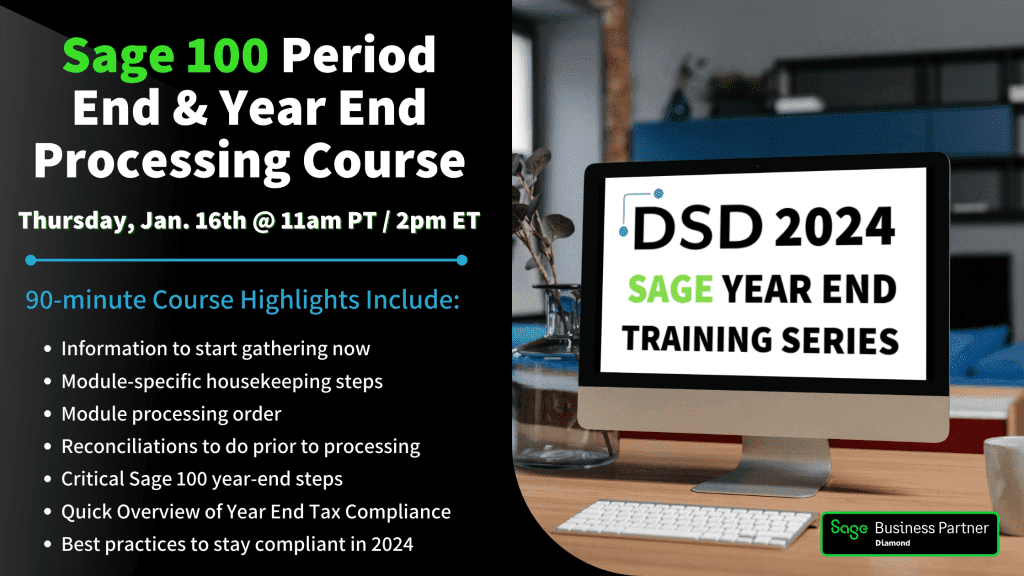

Sage 100 Period End & Year End Processing Course

Thursday, Jan. 16th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Information to start gathering now

- Module-specific housekeeping steps

- Module processing order & what modules can/should be closed together

- Reconciliations to do prior to Year End Processing

- Critical Sage 100 year-end steps

- Quick Overview of Year End Compliance (1099/information returns)

- Best practices to stay compliant in 2025

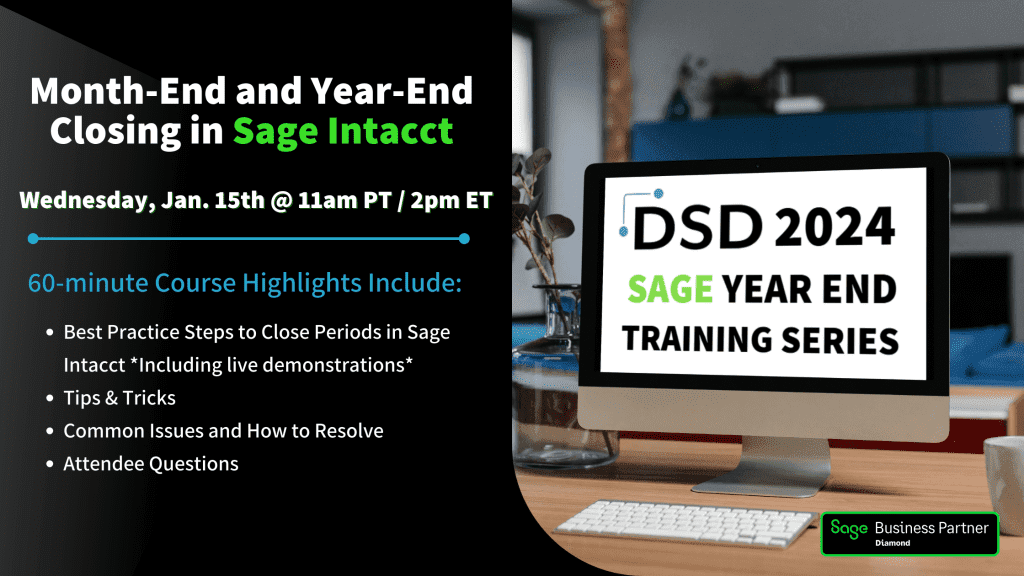

Month-end and year-end closing

in sage intacct

Wednesday, Jan. 15th @ 11AM PST / @ 2PM EST

Class Highlights include:

- Best Practice Steps to Close Periods in Sage Intacct *including live demonstrations*

- Tips & Tricks

- Common Issues and How to Resolve

- Attendee Questions

Exclusive Early Bird Pricing

To make this opportunity even more enticing, we are offering an exclusive early bird pricing of just $50 per class if you register by November 30th. After this date, the price will increase to $75 per class. This is a fantastic opportunity to enhance your skills at a discounted rate!

Additional Benefits

On-Demand Access:

All training sessions will be recorded and made available within 24 hours, allowing you to revisit the material at your convenience whenever you need a refresher.

Training Credits:

DSD Service Level Agreement (SLA) clients can redeem annual training credits for these sessions, providing additional value.

Free Sage HRMS Payroll Processing Course:

Since there has been so significant updates this year, we’re offering our past course On-Demand for free! This is an excellent resource for those looking to refresh their knowledge without additional cost.

Stay Updated with timely upgrades

Ensure your Sage 100 system is up-to-date to avoid compatibility issues with payroll and 1099 forms. If you’re running versions prior to 2020, it’s crucial to schedule an upgrade before the year’s end to maintain compliance and functionality.

REGiSTER TODAY

Don’t let the year-end rush catch you off guard. Register now for the DSD Sage Year-End Training Series and step into 2025 with confidence and expertise. Visit our website to secure your spot and take advantage of early bird pricing before it’s too late!

Prepare yourself for a successful year-end close and a prosperous start to the new year. We look forward to seeing you at our training sessions!