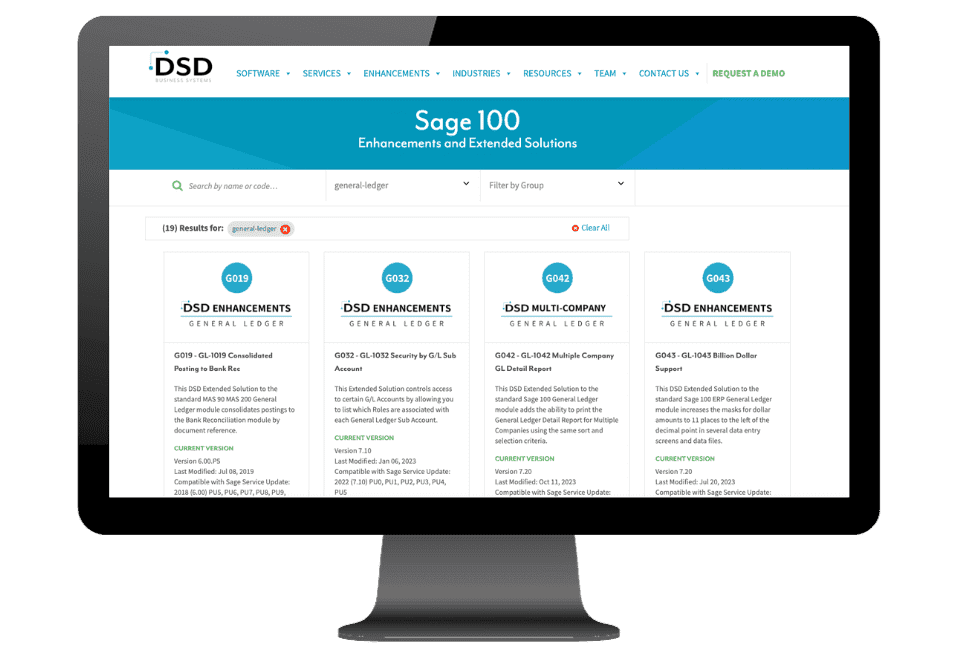

Sage 100 General Ledger Enhancements

The Sage 100 General Ledger module represent a leap forward in financial tracking and reporting capabilities. These enhancements focus on delivering more robust and intuitive tools for financial analysis, budgeting, and reporting, enabling businesses to gain deeper insights into their financial health. With improved data integration, customization options, and real-time reporting features, the Sage 100 General Ledger updates are tailored to meet the evolving needs of modern accounting professionals.

GLAC G/L Account Copy by Company for Sage 100 allows new General Ledger accounts to be copied to other companies during G/L Account Maintenance. There is also an option to update the other company Chart of Accounts when a change is made to an existing account. A new Company Consolidation Maintenance has been added to the Library Master Setup Menu that allows selection of Company Codes for automatic copy of G/L Account additions. There is a checkbox option to allow G/L Account changes to also update other companies.

There is also a checkbox option to have a user prompted when an account is added or changed, and the user may change the companies to be updated.

NOTE: This enhancement requires that ALL companies have the same Account Structure and Mask.

GLCD G/L Daily Transaction Register By Company for Sage 100 allows the General Ledger user the ability to Print and update the Daily Transaction Register for multiple companies at once.

This menu option has be added to the G/L Main Menu. A list box is displayed on this program that lists all company codes and associated checkbox fields. The default for all companies is unchecked. Print, Preview, and Printer Setup buttons are available.

The user will be able to check/select each company that a Daily Transaction Register will be printed for. When the user selects the Print or Preview buttons, a Daily Transaction Register will be printed for each company separately, in Company Code order. The user will be prompted to update the Daily Transaction Register. If Yes is selected, then each company selected will be updated.

- After this utility has been used to combine the various companies’ data, the Standard Financial Statements may be run for the consolidation company. The alternative would be the creation of a Custom Financial which combines the companies within the Custom Report format. The Custom Financial is difficult to create, it must be maintained on an ongoing basis when accounts are added or removed from any of the consolidating companies, and the Custom Financial Statement Update takes much longer to run than does this utility.

- If a complex set of relationships exist among all of the companies, it is easy to create a number of “imaginary” companies strictly for the purposes of consolidating General Ledger data, and reporting various combinations of them in different ways, without creating Custom Financials.

GLDE Posted Detail Editor (Transaction Editor) for Sage 100 is a “real time” enhancement that allows the G/L user to edit posted General Ledger transactions. The Account Number, Posted Date, Posting Remark and Posting Amount can be changed for any transaction. Appropriate changes are also made to the Chart of Accounts Masterfile.

A unique search feature has been incorporated into the Editor, in order to allow the user to quickly locate posted transactions. Posted transactions can be deleted and new transactions can be added. These changes can be tracked using a new report called the Transaction Edit Listing.

GLMC Multi-Currency for Sage 100 ERP (MAS 90, MAS 200) is invaluable for any international or multinational company. Reports, including standard and custom financial statements, can be printed in any currency, and at any override rate. Also if FASB52 is needed, they can be printed to FASB 52 requirements.

The import and export of account balances and detail transactions can be done in any currency, with exchange rate conversions performed automatically.

This DSD enhancement to the standard Sage 100 General Ledger module adds the ability to print the G/L Detail Report, G/L Trial Balance and G/L Financial Reports for Multiple Companies using the same sort and selection criteria. It does not consolidate multiple company information onto one report.

GLMU Multi-Company for Sage 100 is designed to allow a managing company to process G/L transactions for an unlimited number of “subsidiary” companies. GLMU is compatible with DSD APMU. They can be used together or separately.

The GLMU enhancement has been designed to allow a managing company to process G/L transactions for an unlimited number of “subsidiary” companies.G/L transactions may be distributed directly to other companies that have a Sage 100 ERP General Ledger database. Each line item entry contains a new Company Code field. This new field defaults to the Current Company. It may be changed to any other company that has been setup for inter-company processing.When an inter-company distribution is made, a transaction is written to the other company’s Daily Transaction File. For each transaction distributed to another company, a corresponding amount is posted to both companies’ Inter-company Offset Accounts, in order to keep each of those General Ledgers in balance. A pair of Inter-company Offset Accounts must be set up in advance for each company that will have inter-company processing.

During line entry for an inter-company distribution, the General Ledger Account format, and the List Mode feature reflects the Chart of Accounts and the number format for the subsidiary company.

Inter-company Allocations are available in General Journal Line Entry, Recurring Journal Entry, Transaction Journal Entry, in Standard Journals, and in Allocation Maintenance..

For versions 4.40 and below, the enhancement changes the Bank Code to upper- and lower-case, allowing you an additional 26 bank codes (a-z) for a total of 62 codes. Note: The Bank Code field is still a 1-character field.

Starting with version 4.50, this enhancement changes the Bank Code length to 3 characters, except for Payroll. Payroll will only support the original one character code (A-Z, 0-9). Note: Lower-case Bank Codes will no longer be supported.

The following Sage 100 ERP modules are modified for this new feature:

- General Ledger

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Purchase Order

- Payroll

This Extended Solution controls access to certain G/L Accounts by allowing you to list which Roles are associated with each General Ledger Sub Account.

This DSD Extended Solution to the General Ledger module adds the ability to specify a Secondary Company Code for G/L Detail Posting. During the update of any transaction to the GL Detail Posting file, the G/L transaction detail data of the originating company will post in its entirety to the G/L Daily Posting file of the specified Secondary Company Code.

This DSD enhancement to the standard Sage 100 General Ledger module adds the ability to print the G/L Detail Report, G/L Trial Balance and G/L Financial Reports for Multiple Companies using the same sort and selection criteria. It does not consolidate multiple company information onto one report.

GLMU Multi-Company for Sage 100 is designed to allow a managing company to process G/L transactions for an unlimited number of “subsidiary” companies. GLMU is compatible with DSD APMU. They can be used together or separately.

The GLMU enhancement has been designed to allow a managing company to process G/L transactions for an unlimited number of “subsidiary” companies.G/L transactions may be distributed directly to other companies that have a Sage 100 ERP General Ledger database. Each line item entry contains a new Company Code field. This new field defaults to the Current Company. It may be changed to any other company that has been setup for inter-company processing.When an inter-company distribution is made, a transaction is written to the other company’s Daily Transaction File. For each transaction distributed to another company, a corresponding amount is posted to both companies’ Inter-company Offset Accounts, in order to keep each of those General Ledgers in balance. A pair of Inter-company Offset Accounts must be set up in advance for each company that will have inter-company processing.

During line entry for an inter-company distribution, the General Ledger Account format, and the List Mode feature reflects the Chart of Accounts and the number format for the subsidiary company.

Inter-company Allocations are available in General Journal Line Entry, Recurring Journal Entry, Transaction Journal Entry, in Standard Journals, and in Allocation Maintenance..

For versions 4.40 and below, the enhancement changes the Bank Code to upper- and lower-case, allowing you an additional 26 bank codes (a-z) for a total of 62 codes. Note: The Bank Code field is still a 1-character field.

Starting with version 4.50, this enhancement changes the Bank Code length to 3 characters, except for Payroll. Payroll will only support the original one character code (A-Z, 0-9). Note: Lower-case Bank Codes will no longer be supported.

The following Sage 100 ERP modules are modified for this new feature:

- General Ledger

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

- Purchase Order

- Payroll

This Extended Solution controls access to certain G/L Accounts by allowing you to list which Roles are associated with each General Ledger Sub Account.

This DSD Extended Solution to the General Ledger module adds the ability to specify a Secondary Company Code for G/L Detail Posting. During the update of any transaction to the GL Detail Posting file, the G/L transaction detail data of the originating company will post in its entirety to the G/L Daily Posting file of the specified Secondary Company Code.

This DSD Extended Solution to the standard Sage 100 General Ledger module allows you to set up and maintain Allocation Schedules. These schedules consist of one or two account segments and associated percentages.

Within Allocation Maintenance, you may assign a schedule to an allocation, which will create the lines of the allocation according to the schedule.

Provides an amortization utility which uses a daily rate for the purpose of recognizing revenue on service contracts (Sales Order Invoices). These service contracts can have varying terms: 6 months, 12 months, 18 months, for example..

Allows you to associate Bank Codes with specific General Ledger Account Numbers by Source Journal. When that Source Journal is referenced in General Journal update then it will post each line’s transaction amount to the Bank Code associated with that account as a ‘Deposit’ type Bank Reconciliation transaction.

Sage 100 Bank Reconciliation Enhancements

BRMC Multi-Currency for Sage 100 ERP is invaluable to any company that must maintain Bank Account Balances in foreign currencies. Checks, Deposits and Adjustments from Accounts Payable, Accounts Receivable and General Ledger are posted in the Bank’s Currency. The Bank Reconciliation Register, Recap Report, and the Estimate Cash Flow Analysis Report are printed in each Bank’s Currency.

This module is fully integrated with Accounts Payable, Accounts Receivable and General Ledger. The Multi-Currency General Ledger module is required. BRMC provides the Sage 100 ERP (MAS 90, MAS 200) user with the ability to reconcile bank accounts in their original currency. Checks, deposits and adjustments posted from the Accounts Payable, Accounts Receivable and General Ledger modules are stored in the Bank’s Currency. This allows the user to reconcile bank accounts easily and accurately.

Transforms Sage 100 Accounts Receivable from an Accrual Basis to a Cash Basis system. Invoices are expensed when Cash Receipts are entered and updated.

Modifies reconciliation to consolidate like records across multiple company codes into a single entry in the company code in which the Extended Solution is enabled. Checks will always be consolidated.

Check consolidation criteria are: same check number, date, type and source module.

Deposits and adjustments can be consolidated, or left as individual records. Criteria for consolidation of deposits and adjustments are same adjustment type and date.

The records will be cleared from the source companies as the consolidation is performed.

Allows you to set up security by User Code for up to ten specified Bank Codes.

Sage 100 Cash Management Enhancements

- Integrates with Sage 100 Accounts Receivable, Accounts Payable, Inventory Management, Sales Order Processing, Purchase Order Processing and Payroll Processing.

- Perform payment performance reviews for all customers and vendors, and develop more precise cash predictions based on actual payment history, not on payment terms.

- Create expense and revenue projections by using historic seasonal fluctuations in product lines, products sold and recurring expenses such as utilities.

- Build cash flow models that may be “exploded” to create projected cash flow analyses on demand.

Transforms Sage 100 Accounts Receivable from an Accrual Basis to a Cash Basis system. Invoices are expensed when Cash Receipts are entered and updated.

Modifies reconciliation to consolidate like records across multiple company codes into a single entry in the company code in which the Extended Solution is enabled. Checks will always be consolidated.

Check consolidation criteria are: same check number, date, type and source module.

Deposits and adjustments can be consolidated, or left as individual records. Criteria for consolidation of deposits and adjustments are same adjustment type and date.

The records will be cleared from the source companies as the consolidation is performed.

Allows you to set up security by User Code for up to ten specified Bank Codes.