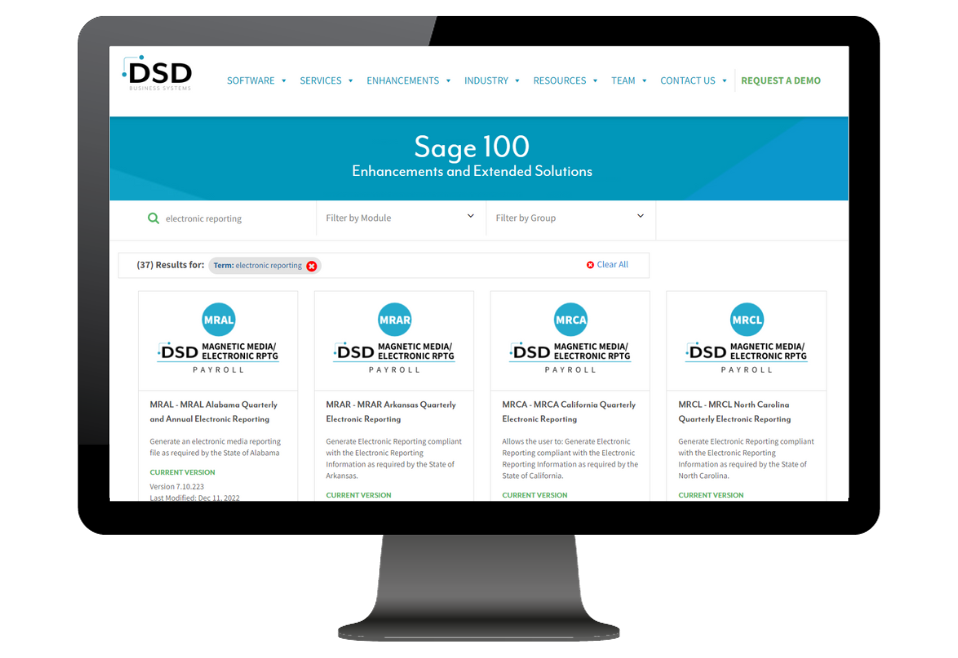

DSD Electronic Reporting

Electronic Reporting is a powerful tool that can help businesses automate their tax reporting processes and comply with local and federal regulations.

Adds the Washington State Unemployment Report. The report can be run in a ‘Fixed Hours’ or ‘Selected Hours’ version.

Adds the ability to assign an employee a 2-character ‘Location’ code as an additional method of categorization. Reports can be run and summarized by location code. Wage, tax expense, tax liabilities and deductions can be posted to different General Ledger account numbers based on this location code.

This DSD Extended Solution to the standard Sage 100 Payroll module allows the substitution of the Department Worked or Home Department into the G/L Cash Account number.

Has the following options:

• Allows the expense portion of Employer Contributions to be posted by department to a specific general ledger account number.

• Allows the user to substitute a segment into the Employer Contribution Deduction Code’s general ledger account number by department.

• All employer contributions may be printed on an employee’s check in the Deduction column. The contribution amount will not be added into the ‘Total’ deduction amounts.

This Extended Solution will expand the printed earnings detail on an employee’s check or direct deposit stub to reflect multiple lines per earnings code based on either the department worked or the pay rate.

Allows the Employer portion of Payroll taxes (including FICA, Unemployment, Medicare and Workman’s Compensation) to be posted to the Job Cost module. The Job Labor Distribution Report has been enhanced to report the tax amounts. Taxes are summarized by Job Number/Cost Code/Employee Number/Earnings Code. A Setup option is available to post the taxes to the G/L Accounts set up in Job Cost. Refer to the Operations section of this manual for explanations of the tax calculation methods.

Adds a utility designed to import data into the Data Entry cycle of Sage 100 ERP Payroll from a variety of ASCII file formats.

Extended Solution PR-1083: Companion Earnings Codes, must be installed and enabled for this Extended Solution to function in Format B.

Extended Solution PR-1018: Automatic Earnings Code Maintenance by Employee, must be installed and enabled for this Extended Solution to function in Format C.

Additional functionality is available if you have Extended Solution PR-1019: Location Processing installed and enabled.

All formats of this Extended Solution are compatible with PR-1090: Multiple Concurrent Local Tax Codes.

Extended Solution PR-1018: Automatic Earnings Code Maintenance by Employee and Extended Solution PR-1019: Location Processing must be installed and enabled for this Extended Solution to function in Format N.

Additional functionality is available with format 8 if you have either Extended Solution PR-1106: Date Worked by Earnings Line or PR-1121: Certified Payroll Report installed and enabled.

NOTE: For version 6.00 / Payroll 2.18, only format 2 and format 8 are available and only 2 character earnings codes are supported. Please refer to the 6.00 user’s manual for more information. If you have questions or need additional information please email enhancements@dsdinc.com.

Adds the ability to set up and maintain Prevailing Wage Rates for specific Labor Codes and Job Numbers. The new Wage Rates will be used during TimeCard and Payroll Data Entry.

Adds the ability to allocate an employee’s earnings over different departments. The allocation may be by employee, department or both. When calculating taxes, the employee’s posted department will be scanned for allocations to other departments then allocated as required. Allocations by employee occur before allocations by department. A new Payroll Distribution Report has been added to the Payroll Reports menu.

Additional functionality exists if Extended Solution PR-1019, Location Processing is also enabled and the PR-1019 option to ‘Process Location by Line’ is checked.

Allows deduction calculation method ‘P’ (Percent of Gross) to be calculated as Federal gross taxable wages minus Cafeteria, Pension or Both types of deductions, times the percentage specified on the Deduction Code Maintenance screen.

This DSD Extended Solution to the standard Sage 100 Payroll module allows Tax Accrual account postings to be made by the employee’s ‘home’ department.

Adds up to 30 new User Definable Fields (UDFs) that can be entered and displayed in Payroll Employee Maintenance Address and Constant Data screen. The UDFs can also be printed on the Quarterly Government Report, W-2 Form and the Payroll Check Form. One UDF can be used as a sort option in Payroll Check Printing.

Each of the UDFs can be defined as one of the following data types:

- String (with up to 60 characters)

- Uppercase String (with up to 60 characters)

- Yes or No Flag

- Numeric (up to 10 digits with mask control)

- Date.

This DSD Extended Solution to the standard Sage 100 ERP Payroll and Accounts Payable modules automatically creates Accounts Payable invoices in the amount of Payroll Employer Tax checks and ‘Other’ Deductions.

Adds the ability to print Payroll checks and direct deposit stubs in Employee Sort Field or Department/Employee Name order. This Extended Solution will not function with the ‘Use Graphical Forms’ option checked in Payroll Setup.

This DSD Extended Solution to the Payroll module modifies the Periodic Accrual Utility in the following ways:

- You may indicate the type of benefit to be processed

- ‘Minimum Yearly Hours’ has been added to the selection criteria

- There is an option to ‘Zero Out Hours On Anniversary Date’.

Allows information about individual unions to be set up and maintained. Union benefit packages may also be set up and maintained unique to a Labor Code. Wages and union benefits associated with Union Payroll are automatically processed during Payroll Data Entry. Multiple new reports have been added to support union reporting requirements; these reports are produced from the Perpetual Check History file.

This Extended Solution requires integration of the Job Cost module with Payroll. If you wish to integrate this Extended Solution with TimeCard, please refer to Extended Solution TC-1036: TimeCard Integration with Union Payroll.

This Extended Solution to the Payroll module adds a ‘Check’ limit to Workers’ Compensation Processing and an override Workers’ Compensation State to an employee’s state tax record.

Adds the ability to specify the yearly accrual limit based on the number of months of employment.

This Extended Solution to the Payroll module adds a new option from Deduction Maintenance Taxes screen for ‘Local Code,’ to allow for the reduction of taxable income by the amount of the deduction by individual locality.

Adds a Date Worked field or Start and End Date fields to Payroll Line Entry for Earnings Codes that belong to any Pay Type specified in Setup.

Additional functionality is available if you have Sage Extended Solution PR-1137, Payable Sick Benefit, and/or PR-1142, Reimbursement Earnings Type, installed and enabled.

Adds a Half Time Due earnings line to Payroll Data Entry. There are no hours associated with Half Time Due, only an amount. An employee is eligible for Half Time Due when, on a single check, they are being paid Regular Hours, Overtime Hours and a Bonus.

Allows you to print Direct Deposit stubs for employees who are not Direct Deposit enabled. It also adds the option for multiple-column Tax/Ded printing, and a new ‘Earnings Code YTD Hours’ form field to Direct Deposit Stub Printing.

Calculates Overtime during Payroll Entry based on a weighted average of an Employee’s total earnings per pay entry which is then applied to those hours that are in excess of their Pay Cycle or based on employee’s actual overtime hours.

Adds a Combined Direct Deposit File Generation utility to the Direct Deposit menu. Sage Payroll Direct Deposit must be enabled for this Extended Solution to function.

Creates a Certified Payroll Report that does not require the TimeCard module and optionally does not require the Job Cost module in order to print. The Certified Payroll Report provides a report suitable for submission to governmental agencies. This report uses data from the Payroll module to produce a weekly report with a daily breakdown of hours, pay and deductions for a job and an optional Statement of Compliance.

Job Numbers and Labor Codes can be flagged as participating in certified payroll reporting. If Job Cost is not installed and enabled, then the user will have access to a new Job Maintenance option within Payroll.

The Certified Payroll Report can be run prior to update of the Check Register, or from Perpetual Payroll History.

A new field for ‘Date Worked’ has been added to Earnings Code lines and will be used on the report.

This DSD Extended Solution to the Payroll module allows “Foreign Employees” to be exempt from some federal taxes.

Allows you to post wage expense by Labor Code using segment substitution. This Extended Solution will disable the standard option to specify an account number in Labor Code Maintenance for the wage expense.

This DSD Extended Solution to the Payroll module accrues vacation dollars for hourly employees on a weekly pay cycle. These dollars are calculated based on the vacation accrual rate multiplied by the pay rate associated with each vacation eligible earnings line. The dollars are then relieved as vacation is used by calculating an average pay rate based on the number of available hours as applied to the current total value of the bucket.

Additionally you can maintain a minimum number of earnings hours required on a pay entry in order for vacation accrual to take place.

This DSD Extended Solution requires the Payroll standard option ‘Allow Benefit Accruals From’ to be set to ‘Data Entry Only’ and that the Custom Office module is Activated.

Use of the ‘Eligibility Wait’ and ‘Eligibility Hours’ fields in Benefit Schedule Maintenance for employees subject to this processing will produce undesirable results.

Writes the date of the last Payroll check to a specified Custom Office Payroll Employee user defined field during Check Register update. The Custom Office module must be activated.

Modifies the update to Payroll Check History to include data from three specified deduction codes which hold 401(k) information.

Adds a fourth benefit: Payable Sick. It is designed to be applied only to Full Time Employees who are incented to not use their Sick Hours by paying them for their Unused Sick at the end of the year.

The Payroll Option ‘Reset Employee Benefits at Year End’ must be unchecked and ‘Hours to use for Benefit Limit’ set to ‘Accrued Hours Only’ in order for this Extended Solution to enable.

The Custom Office module is required in order for this to function.

Adds a utility and a report that verify pension enrollment eligibility.

Modifies the warning which displays in Payroll Entry when the hours entered for a benefit exceed what is available. The enhanced warning will provide you the number of hours which the employee has available, then will allow you to accept the entry or reset the number of hours on the line to the available balance.

Additional functionality exists if Extended Solution PR-1137, Payable Sick Benefit is enabled.

Will restrict which users have the ability to modify an Employee’s Benefit hours via a new Payroll Security Event.

Additional functionality exists if Extended Solution PR-1137, Payable Sick Benefit is enabled.

Adds an Employee Termination Utility to the Payroll module. Time Card and Custom Office must be active for this Extended Solution to function.

Adds the ability to set up Reimbursement type Earnings Codes in Earnings Code Maintenance.

M/R Quarterly Electronic Reporting (MR--) - Per State

Generate Electronic Reporting compliant with the Electronic Reporting Information as requested by the relevant state. Each state allows for certain data, such as employee name, Social Security Number, etc.

It also provides the ability to generate an Electronic Reporting summary report that, after the creation of the Electronic Reporting file, reports the information needed to complete any Electronic Reporting Transmittal form that must be submitted with the Electronic Reporting. Available for the following states:

Alabama, Arkansas, Arizona, California, Colorado, Connecticut, Florida, Georgia, Hawaii, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Virginia, Wisconsin, West Virginia.