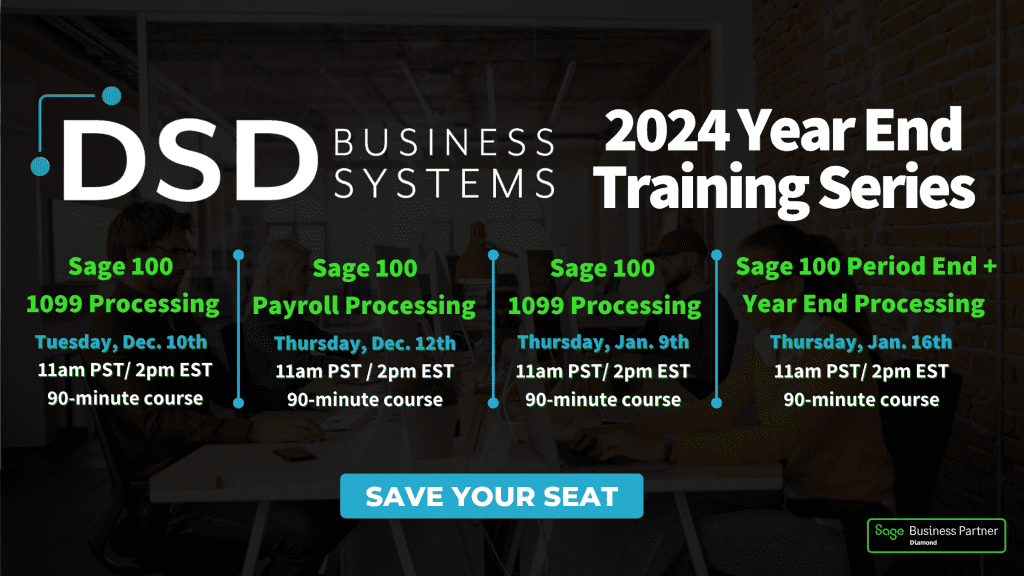

2024 DSD Sage Year End Training Series for Sage 100

Our most popular series is back for 2024! Join us for the DSD Sage Year End Training Series covering Year End Processing in Sage 100 for 1099s, Sage Payroll, and Period End / Year End Reporting!

Register now to secure your spot at $75 per class for training sessions packed with best practices for a successful Sage 100 year-end close.

PLEASE NOTE: All sessions will be recorded and made available on-demand within 24 hours of event. DSD Service Level Agreement (SLA) clients should contact us redeem annual training credits. For more technical content, visit the Sage 100 Year End Resources page.

Sage 100 1099 Processing Course

Tuesday, December 10th @ 11am PST / 2pm EST

Class highlights include:

- Verify that your version of Sage 100 can process 1099s for 2024

- Overall IRS guidelines for 1099 reporting

- Cleaning up vendor 1099 classifications and verifying reporting amounts

- Common pitfalls for 1099 processing

- Using Aatrix in Sage 100 to report 1099 information electronically

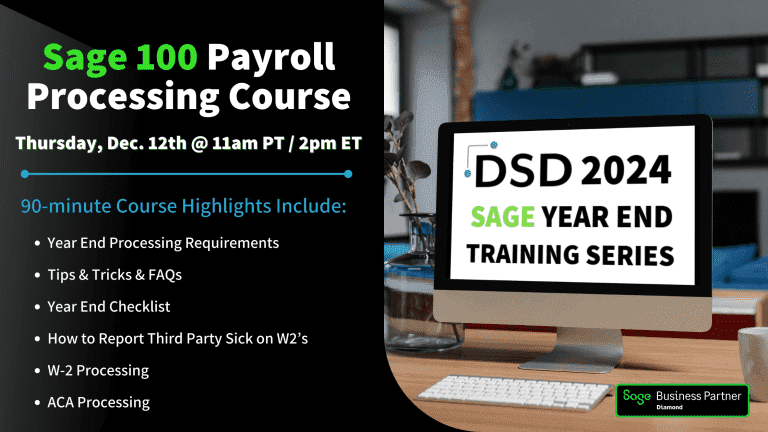

Sage 100 Payroll Processing Course

Thursday, December 12th @ 11am PST / 2pm EST

Class highlights include:

- Year End Processing Requirements

- Tips & Tricks & FAQs

- Year End Checklist

- How to Report Third Party Sick on W2’s

- W-2 Processing

- ACA Processing

Sage 100 1099 Processing Course (Repeat)

Thursday, January 9th @ 11am PST / 2pm EST

Class highlights include:

- Verify that your version of Sage 100 can process 1099s for 2024

- Changes to 1099 boxes for 2024

- Overall IRS guidelines for 1099 reporting

- Cleaning up vendor 1099 classifications and verifying reporting amounts

- Common pitfalls for 1099 processing

- Using Aatrix in Sage 100 to report 1099 information electronically

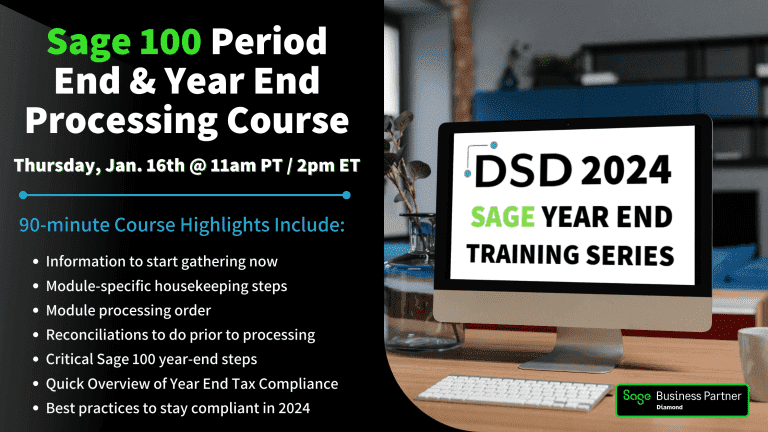

Sage 100 Period End & Year End Processing Course

Thursday, January 16th @ 11am / 2pm EST

Class highlights include:

- Information to start gathering now

- Module-specific housekeeping steps

- Module processing order & what modules can/should be closed together

- Reconciliations to do prior to Year End Processing

- Critical Sage 100 year-end steps

- Quick Overview of Year End Tax Compliance (1099/information returns)

- Best practices to stay compliant in 2025

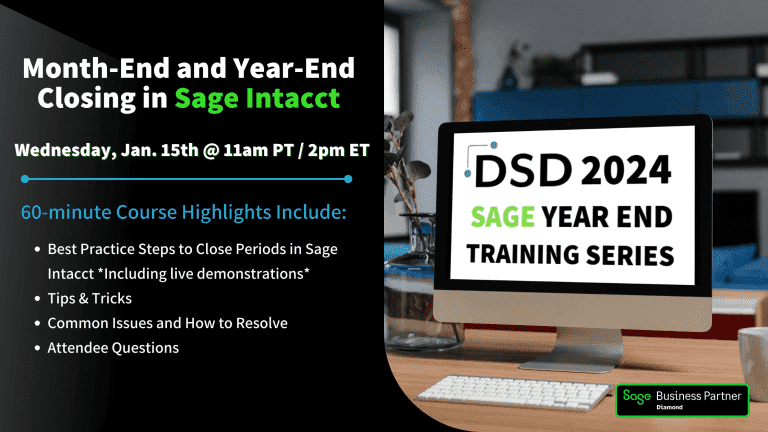

Month-End and Year-End Closing in Sage Intacct

Wednesday, January 15th @ 11am PST / 2pm EST

Class highlights include:

- Best Practice Steps to Close Periods in Sage Intacct *Including live demonstrations*

- Tips & Tricks

- Common Issues and How to Resolve

- Attendee Questions

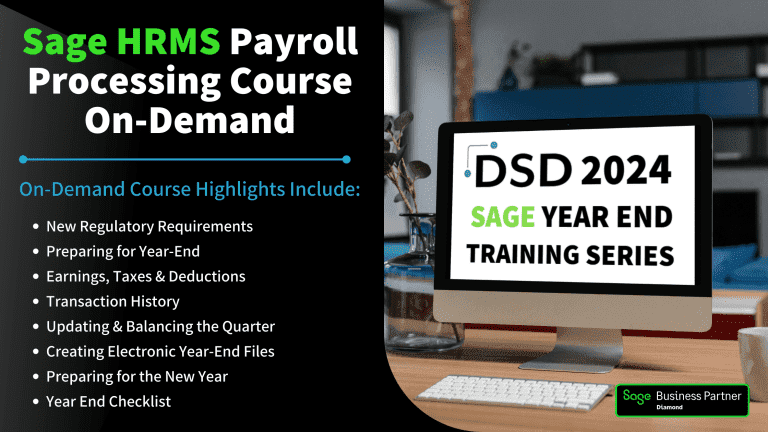

Sage HRMS Payroll Processing

There have been no significant changes or updates for Sage HRMS Payroll Processing this year so we are offering our past training course on-demand for FREE!

Highlights include:

- Regulatory Requirements

- Preparing for Year-End

- Earnings, Taxes & Deductions

- Transaction History

- Updating & Balancing the Quarter

- Creating Electronic Year-End Files

- Preparing for the New Year

- Year-End Checklist

Aatrix 2024 Year-End eFile deadlines dates

Aatrix has posted the 2024 Year-End eFile deadlines dates, please refer to the following link to review the General Due dates & State Copy eFile Due Dates: https://efile.aatrix.com/pages/public/FilingDeadlinesPublic.aspx?v=ATX000

Below you will find the General Due Dates:

- 1099-S Recipient Copy Date ———————————— Feb 14th 3:00 PM CST

- All other 1099s Federal Date ———————————— Mar 28th 3:00 PM CST

- 1099-NEC Federal Date ———————————— Jan 30th 3:00 PM CST

- Combined W2 & 1095-C Copy Date ———————————— Jan 25th 3:00 PM CST

- 1095 Employee Copy Date ———————————— Feb 28th 3:00 PM CST

- 1095C & 1095B (ACA) Federal Date ———————————— Mar 28th 3:00 PM CST

- T4 Employee Copy Date ———————————— Feb 26th PM CST

- T4 Fed Only Date ———————————— Feb 26th 3:00 PM CST

- W-2 Federal Date ———————————— Jan 30th 3:00 PM CST

- W-2/1099 Employee/Recipient Copy Date ———————————— Jan 30th 3:00 PM CST

Additional Sage 100 Year End Resources

additional learning

sage 100 Checklists

Additional Sage HRMS Year End Resources

additional learning

Year-end Classes (U.S. Customers)

Year-end Classes (Canadian Customers)

Sage University

In Need of an Upgrade? Schedule it ASAP!

Keeping your Sage 100 up to date can save you time and headaches down the road. With lots of changes and updates coming, you can easily fall behind and run into various issues. Contact DSD Sage 100 Support today to get your upgrade scheduled before it’s too late.

Sage 100 Payroll Year End Form Incompatibility:

If you are running Sage 100 versions 2018 or 2019 and don’t complete a Sage 100 upgrade by the end of 2024, will not be able to install Payroll 2.24.0 and will be unable to use Aatrix to generate your Payroll 2024 year-end forms and reports.

No 1099 Form Compliance for Year End Processing:

Customers not running a compatible version of Sage 100 of version 2020 or higher will not be able to install the 2024 IRD. In addition, Aatrix will not be compatible with Sage 100 versions prior to 2020 and will be unable to generate the 1099 forms.

Fill out the form to get your Sage 100 Upgrade scheduled right away.