Right through user’s own ERP, Avalara with Sage Intacct allows them to measure rates, file returns, handle exemption certificates, and more. Read on to learn about the benefits and features, various products, and a video demo that they have teamed up to provide for you and your organization. See how Avalara’s integration with Sage Intacct does the hard work so organizations don’t have to.

Avalara + Sage Intacct Benefits and Features

Enable your ERP to handle the management of exemption certificates.

Enter a certificate number into a customer record with Avalara CertCapture, and the solution holds certificates on file in user’s ERP and is available at the point of purchase.

"The service is easy to manage and it has increased our overall compliance, ensuring timely filing of sales tax returns in all jurisdictions."

Debora Correa Talutto

Accesso

Reduce returned shipments by improving rate accuracy.

AvaTax for Sage Intacct confirms addresses with rooftop precision in over 12,000 tax jurisdictions throughout the United States. This means that tax is applied more precisely than when using ZIP codes and reduces the risk of incorrect distribution.

Manage taxability rules through a large product inventory with ease.

AvaTax for Sage Intacct keeps track of a large number of product taxability regulations in order to apply the correct tax to thousands of SKUs.

Apply the appropriate tax to each client, regardless of location or distribution channel.

Users can add a single tax profile to each customer with AvaTax for Sage Intacct. That is, whether they bought from the online site, a POS scheme, or a direct sale, the correct tax is applied.

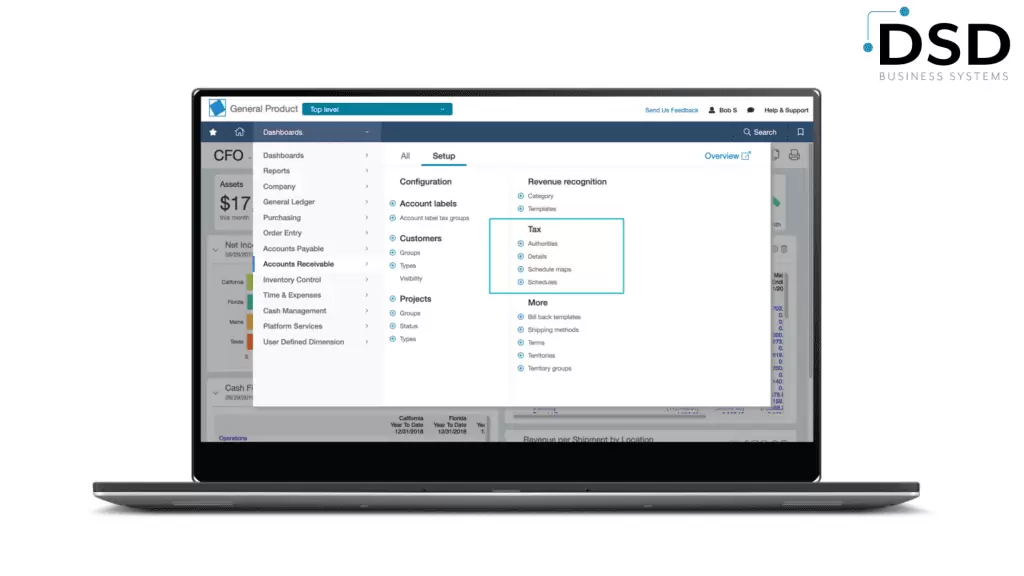

In your ERP, you can manage tax calculations natively.

The only tax enforcement solution that interacts directly with ERP applications is Avalara’s tax calculation product for Sage Intacct. Users can calculate prices on goods and services at the point of sale directly from Sage Intacct with Avalara AvaTax for Sage Intacct.

Remove the time-consuming filing and remittance processes.

The returns product from Avalara allows users to consolidate a single worksheet and pay a single sum for their entire tax liability. Avalara Returns files and pays the taxes on user’s behalf with state and local governments.

"If we had to manually calculate sales tax on invoices, we would probably have to add an additional staff person in accounting, since we generate over 600 invoices per month."

Director of Finance & Accounting

Information Technology and Services Company