SAGE INTACCT

Sage Intacct for

Financial Services

The top accounting software used by more than 670 financial services firms who control more than $1.3 trillion in AUM. Learn more about Sage Intacct, the cloud-based financial solution that is perfect for businesses that provide financial services.

Learn more about Sage Intacct, the Cloud Financial Accounting Software that’s Ideal for Financial Firms

Financial services accounting software—the 1st and only preferred provider of the AICPA

Top-performing financial leaders are forward-thinkers who rely on current information to make wiser choices. Create new legal organizations quickly, control assets under management through direct investments and real estate, and make data-driven decisions based on multi-entity financial consolidation.

- Use best-in-class, multi-dimensional reporting that deliver real-time insights across multi-entities

- Reduce consolidations from weeks to minutes

- Reduce costs by 80-90% in the cloud

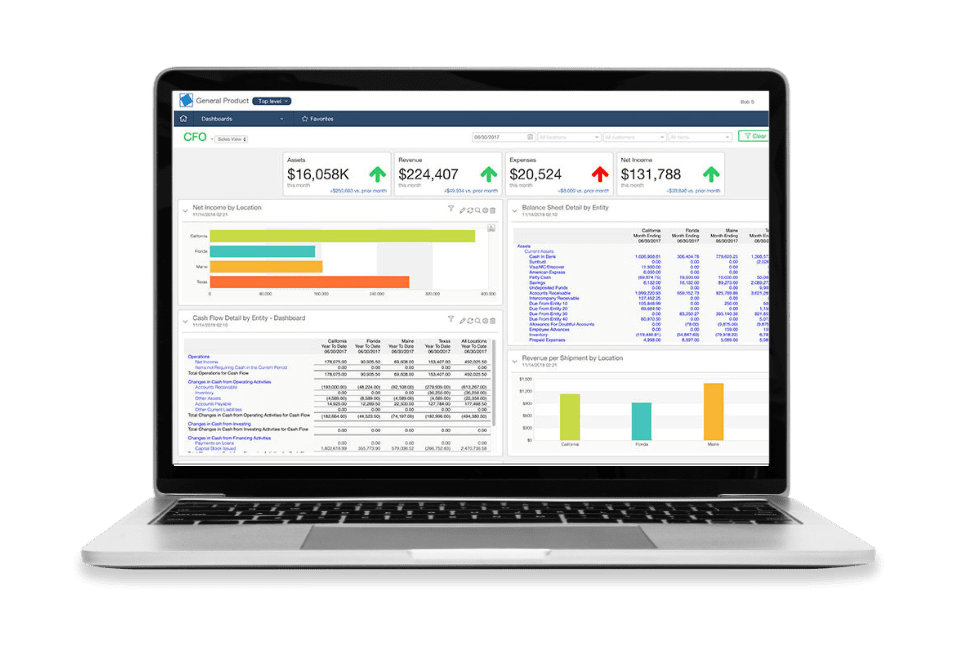

Fast consolidations that make you smarter without mind-numbing Excel tasks

Make smart decisions to handle multi-entities, various currencies, and ever-changing compliance mandates while maximizing corporate performance.

Get a quick closing and real-time analytics—in minutes—with push-button consolidations for the most impact on the performance of your financial organization.

- Multiple entities

- Multiple currencies

- Multiple asset types

- Multiple locations

Financial services multi-dimensional reporting and data with real-time visibility

Be innovative and discover new, yet proven, ways to increase output, cut expenses, and streamline procedures such as the month-end close, consolidation, management, and financial reporting.

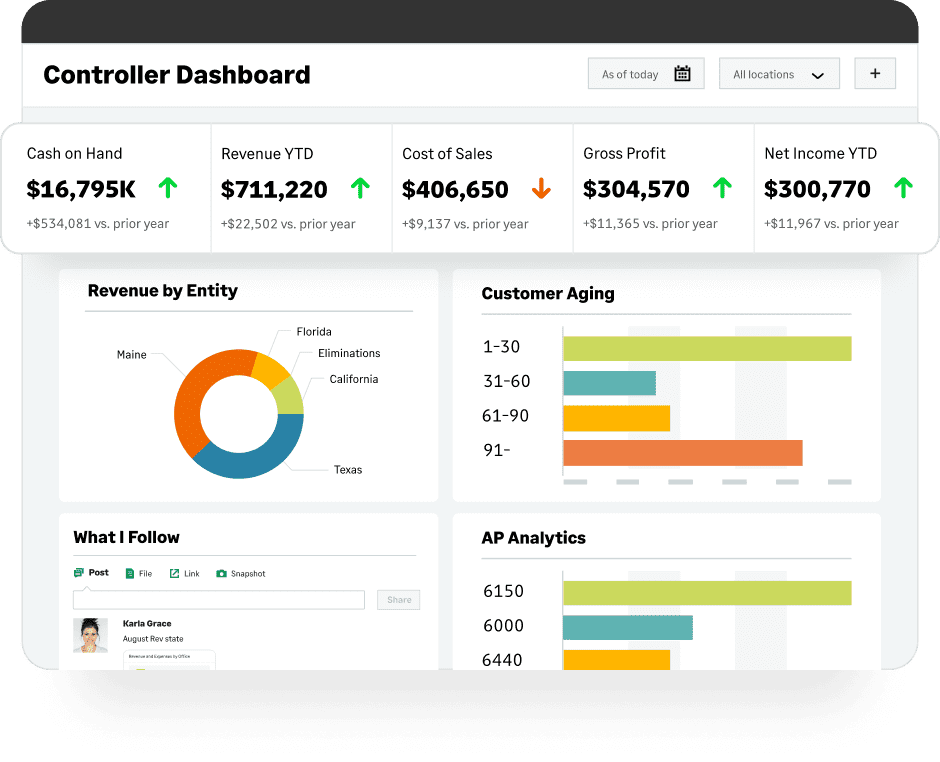

- Intuitive, real-time financial dashboards

- Drill deep into the data with unlimited multi-dimensions

- Custom, ad hoc reporting capabilities

Manage costs. Assign internal controls. Minimize risk.

Sage Intacct’s cloud-based solution offers significant benefits to financial services firms – all in one integrated system.

- Streamline payment processing while increasing efficiency for nearly 70% less than average processing costs

- Use the cloud to securely access key data anytime, anywhere

- Seamlessly scale as your business grows – without adding headcount

- Implement user access controls

Sage Intacct Success Stories

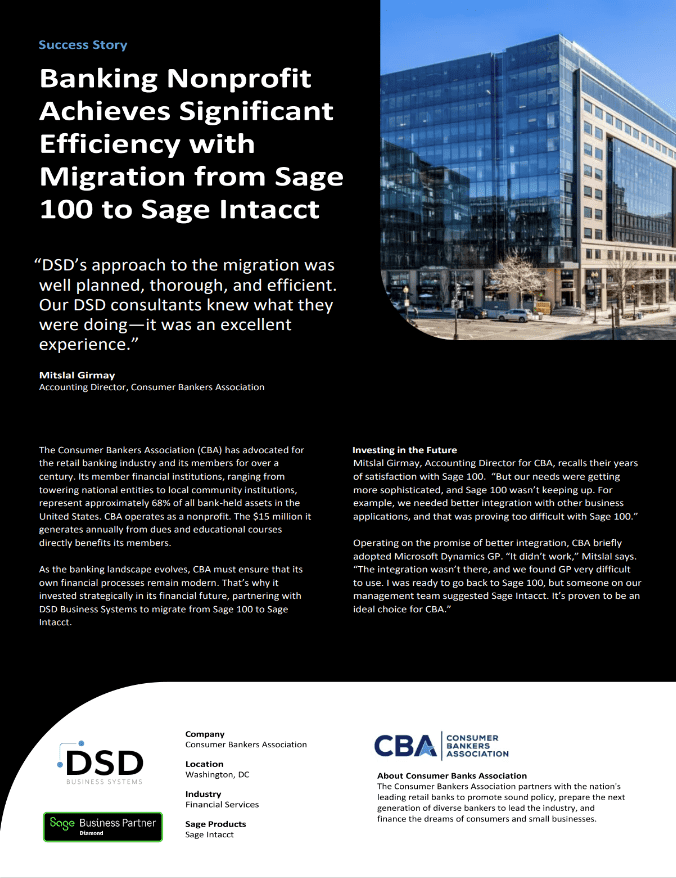

Banking Nonprofit Achieves Significant Efficiency with Migration from Sage 100 to Sage Intacct.

As the banking landscape evolves, CBA must ensure that its own financial processes remain modern. That’s why it invested strategically in its financial future, partnering with DSD Business Systems to migrate from Sage 100 to Sage Intacct.

After identifying Sage Intacct as an ideal replacement, the organization reached out to DSD, one of the country’s leading Sage business and technology partners. “We liked that they were experts in both Sage 100 and Sage Intacct,” says Mitslal.

“DSD’s approach to the migration was well planned, thorough, and efficient. Our DSD consultants knew what they were doing—it was an excellent experience.”

Mitslal Girmay - Accounting Director, Consumer Bankers Association

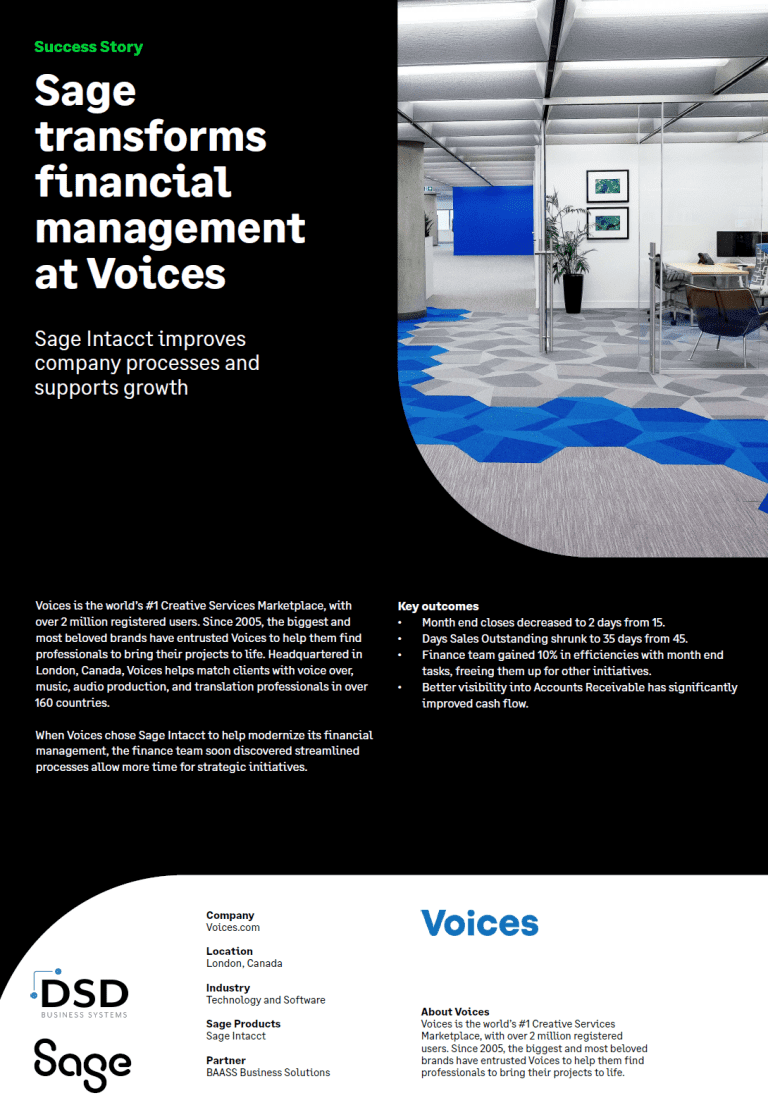

Sage Intacct transforms financial management at Voices

Before Sage Intacct, Brittany says her team was composed of A/R specialists who spent a lot of time doing manual work. Because Sage Intacct automates many manual tasks, she says finance team positions have evolved to include more accounting-based roles, such as month-end reconciliations and adjustments.

When Voices chose Sage Intacct to help modernize its financial management, the finance team soon discovered streamlined processes allow more time for strategic initiatives.

Sage Intacct Product Tour

Do you want to see a demo now? In this 23 minute product tour, you can expect:

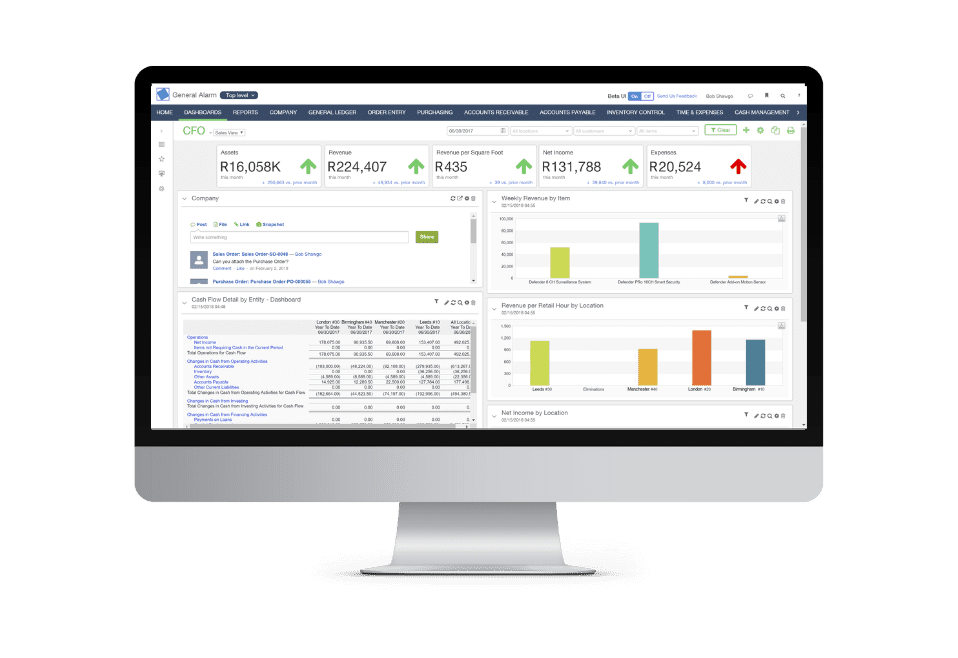

Key Features: Sage Intacct offers a dimensional general ledger, continuous consolidation, easy-to-use dashboards, workflow automation, and a robust audit trail. It’s designed to address common challenges like multi-entity consolidations, data visibility, compliance, and inefficient processes.

User Interface and Accessibility: The platform allows for customizable dashboards with role-based access, featuring performance cards for quick insights, and real-time collaboration tools. Users can access the system from any internet-connected device, ensuring flexibility and ease of use.

Financial Reporting and Consolidation: The software provides dynamic allocations, simplified inter-company transactions, and automated consolidation processes, aimed at improving reporting accuracy and efficiency. It includes features for comprehensive financial reporting and analysis, enhancing strategic decision-making.