Sage Fixed Assets

Take control of your fixed asset management with Sage Fixed Assets, a best-in-class solution. Stop overpaying taxes and insurance premiums and start increasing your bottom line.

Capture, track, and maximize your fixed assets

A fixed asset management solution results in more accurate physical inventories, less money spent on taxes and insurance, maximized benefits from accurate depreciation calculations,

better regulatory compliance, and disaster preparedness.

Sage Fixed Assets software gives you the flexibility to manage and optimize your fixed assets throughout their useful life. Learn how our powerful depreciation calculation engine and intuitive reporting simplify asset management and accounting across your business.

Benefits of Sage Fixed Assets Software

Gain valuable insights

Budget and track costs for projects before they become fixed assets. Project the depreciation of assets on a variety of scenarios that fit your complex business needs.

Organize assets

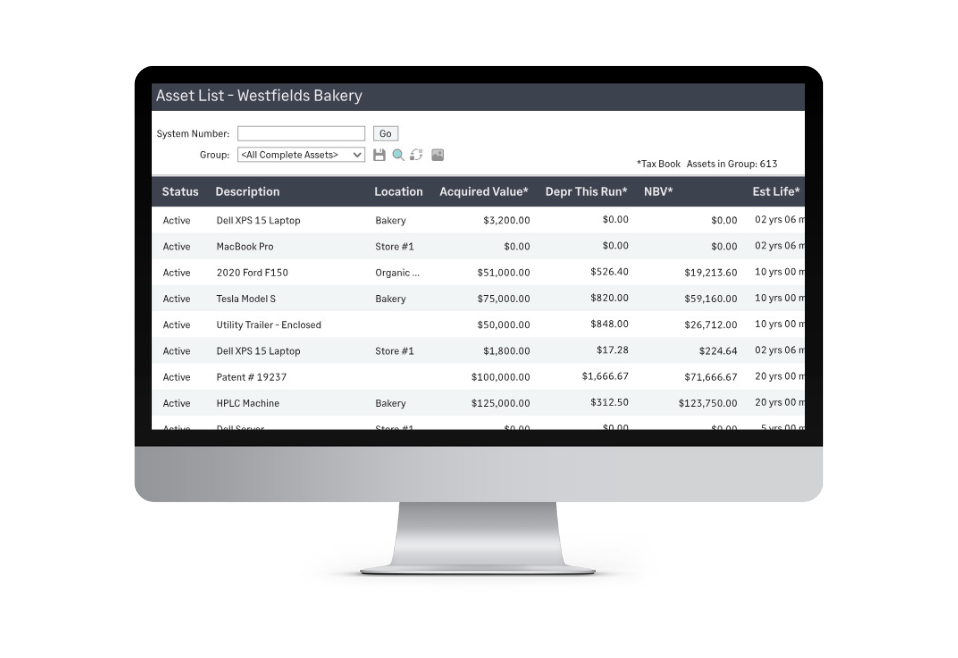

Keep track of the value of your assets throughout your equipment’s lifecycle. Know what and where your assets are throughout your business with complete visibility.

Maximize tax savings

Stay compliant with IRS regulations with annual tax compliance updates. Keep accurate accounting records that can lower tax payments over your assets’ lifecycle.

Know true asset value

Avoid risk associated with unidentified ghost and zombie assets, including fraud, property tax overpayment, and insurance premium overpayment.

Sage Fixed Assets Management Software

Get a better understanding of your fixed assets. These four modules in our fixed asset software gives you full visibility and control of your fixed assets.

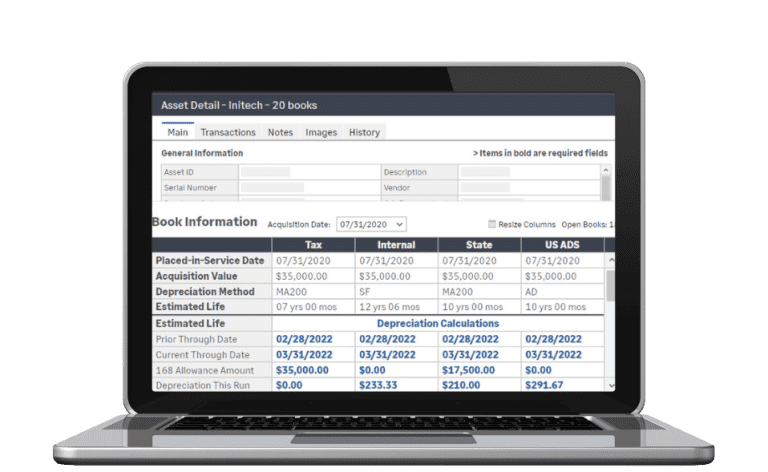

Depreciation

Manage fixed assets using depreciation softare with 50+ depreciation methods.

Planning

Handle as many projects as you need, regardless of type or size.

Tracking

Stop lost assets and overpaying taxes with fixed asset tracking software.

Reporting

Generate customer reports based on your unique business needs.

Asset Maintenance

Unlock hidden value in your fixed assets with time-saving automation and seamless compliance for accurate tracking, maintenance, and reporting.

Sage Fixed Assets: Seamless Integration with Sage 100

Take control of your asset management with the seamless integrations of Sage 100 and Sage Fixed Assets. This demo provides an in-depth look at how these solutions work together to streamline processes, enhance efficiency, and ensure compliance with IRS and GAAP standards.

Discover how you can optimize asset creation, manage journal entries effortlessly, and leverage a comprehensive depreciation module to maximize your business’s potential.

Sage Fixed Assets Integrations

Connect your tools and systems with ease. Sage Fixed Assets integrates with most popular ERP and accounting solutions.

Sage Intacct

Sage 100

Sage 300

Microsoft Dynamics

Plex

SAP

JDE

Oracle

Sage Fixed Assets Cloud Hosting

Working remote? Get real-time access to your fixed assets from anywhere! DSD provides a modern, safe, and secure solution for cloud hosting with the Sage Provisioning Portal.

On-premises or cloud-hosted for access any time, from anywhere. Employ the cloud hosting provider of your choice or leverage the industry-leading AWS and Cisco technology for a secure browser-based experience without the cost of rebuilding or re-platforming.

On-the-go access

Access your Sage Fixed Assets from your mobile device, home office, and on-the-go.

Protects your data

Cloud hosting ensures environment data is safe, available anywhere, and is resilient.

Secure multi-factor authentication

Get single sign-on and multi-factor authentication via Cisco's Duo Native Single-Sign On Integration.

End-to-end encryption

Keep data safe with encrypted communication between client/server and data encryption at rest.

What Customers are Saying

Sage Fixed Assets paid for itself in the first year of use, and we estimate that using the software has reduced the time spent on asset tracking and recording by about a third.

Jill kight, Cost Analyst at Catawba Valley Medical Center

Because I report to several regulatory agencies, all of which want reports in a different format, Sage Fixed Assets makes my life much easier. It also helps me prepare GASB 34-compliant financial statements.

Beverly Bales, Rinehart Controller at City of Beckley, WV

We've gained the ability to track and maintain a detailed listing of our physical inventory, depreciate those assets monthly, and run a variety of reports as frequently as we need them.

Tammy White, Fixed Asset Manager at Maury Regional Hospital

Sage Fixed Assets Resources

Frequently Asked Questions

Fixed assets are tangible and intangible assets expected to provide economic benefit to a company over the long term (greater than 12 months).

Examples of tangible fixed assets you may see daily in your organization are buildings, vehicles, computers, chairs, and desks. Intangible assets include patents, trademarks, goodwill, and copyrights. One trait that all fixed assets have in common is a useful life greater than one year.

Fixed assets management is the process of tracking and maintaining an organization’s tangible and intangible fixed assets for financial and tax accounting, depreciation, maintenance, and physical location purposes.

Since fixed assets are a critical part of a business’s profitability, using spreadsheets to track valuable company property can be inefficient and even risky. Spreadsheets are prone to errors, have the potential for data loss, have limited reporting options, and do not readily provide the flexibility to record complex transactions and changes in asset location.

Fixed asset software such as Sage Fixed Assets makes it easy to record asset purchases, transfers, disposals, and update asset location. By using a fixed asset solution that accurately tracks all details related to fixed assets, businesses can lower insurance costs, avoid regulatory non-compliance fines, and save money when updating equipment.

Some of the leading accounting and ERP solutions offer asset depreciation; however, they aren’t built to manage the complex and complete lifecycle of fixed assets. ERP solutions also struggle calculating depreciation for both GAAP and tax compliance or other purposes if needed. Sage Fixed Assets complements accounting and ERP solutions because it is built from the ground up to manage the complete fixed asset lifecycle and integrates seamlessly with most general ledgers, reducing the risk of double entry and human error.

To get the maximum benefit of your fixed assets, look for fixed asset software that offers:

- Full lifecycle management – acquisition, depreciation, transfers, disposals, construction in progress (CIP), and tracking, including barcode tracking.

- The latest and most accurate tax and GAAP rules and calculations.

- Robust financial reporting, including general ledger posting, depreciation expense, and roll-forward reports for reconciliations.

- Accurate tax reporting with annually updated IRS Forms 4562, 4797, and others.

- Flexible deployment options and integration links with other software to continue to do business your way–whether that’s on-premises or in the cloud.

Sage Fixed Assets is ready to use after installation, and you can start customizing preferences, setting up templates, and adding assets groups easily. Going a step further, you can create custom depreciation methods.

For more extensive customizations such as custom reports and integration assistance from Sage Expert Services, contact your Sage Account Manager for more information and related pricing.